Markets were in a reflective mood early Monday after last week's shock jobs report as investors prepared for a flurry of earnings reports this week.

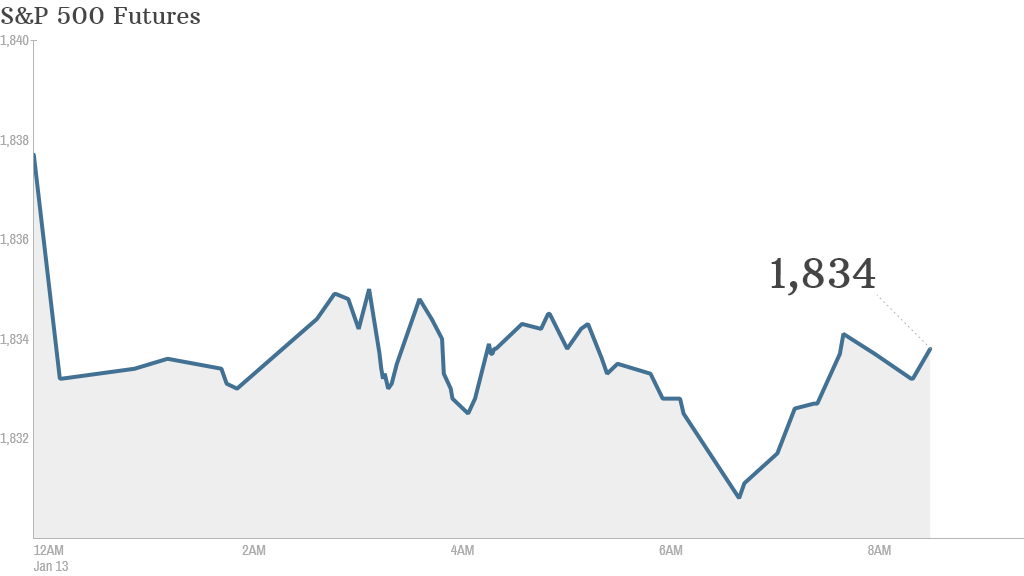

U.S. stock futures for all the major indexes were edging lower ahead of the opening bell.

Investors and traders are still digesting Friday's jobs report, which showed an extreme slowdown in job creation in the final month of 2013. Many experts are now saying colder-than-normal temperatures in December hit hiring.

Related: Wolves of Wall Street to report earnings

Now investors are looking ahead to the first big round of fourth quarter earnings coming later in the week.

JPMorgan (JPM) and Wells Fargo (WFC) are scheduled to report Tuesday morning, while firms including Bank of America (BAC), General Electric (GE) and Intel (INTC) are up later in the week.

Ahead of its earnings, yoga pant retailer Lululemon (LULU) cut its fourth quarter earnings guidance, saying that traffic and sales have declined since the beginning of January.

Shares of Beam (BEAM) shot up 25% after the spirits maker announced it was being acquired by Japan's Suntory for $16 billion. Beam, which produces Sauza tequila and Jim Beam whiskey, said the transaction was expected to close in the second quarter of 2014. Suntory is paying $83.50 per share -- a 25% premium over Beam's closing price on Friday.

Related: Ford unveils all-new F-150 in Detroit

Shares in automakers may also be moving this week as Detroit hosts the North American International Auto show. Major automakers such as General Motors (GM) and Ford (F) use the event to showcase their newest vehicles and innovations.

At 2:00 p.m. ET Monday, the U.S. Treasury Department will release its monthly budget report.

U.S. stocks finished mixed Friday as investors were taken by surprise by the weak employment report.

European markets edged higher in afternoon trading.

In Asia, roughly 50,000 anti-government protestors attempted to shut down Bangkok as they try to force Thailand's prime minister from office.

The country's main stock market index has fallen by roughly 25% since mid-May, but rose by 2.2% Monday.

Other Asian markets ended with mixed results.

Japan's markets were closed.