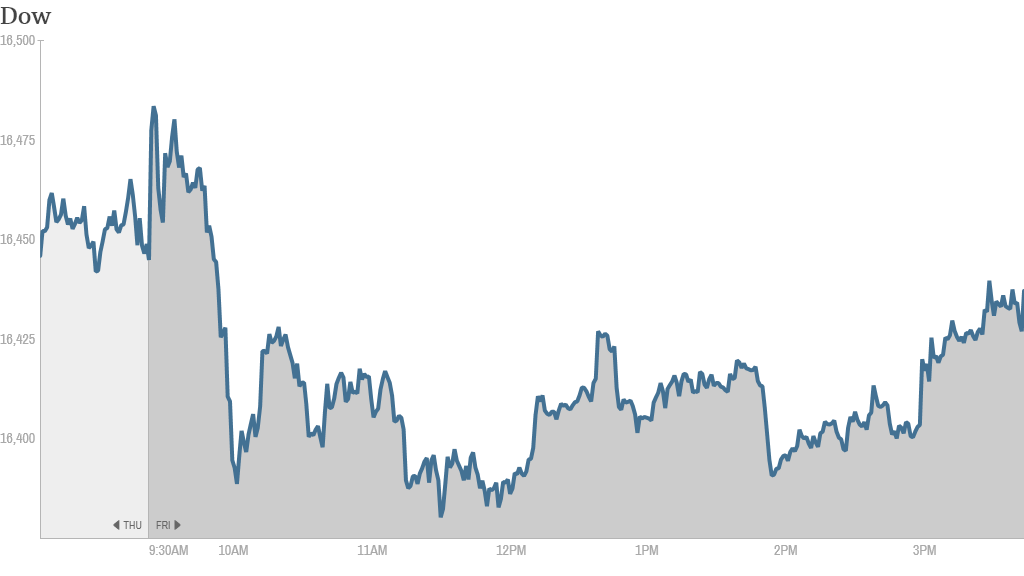

Stocks seesawed Friday as investors tried to figure out how a weak jobs report would impact future moves by the Federal Reserve.

The Dow ended flat, while the S&P 500 and Nasdaq managed to edge out slight gains. CNNMoney's new Tech 30 index was mostly unchanged. The major indexes ended the first full trading week of 2014 mixed, with the Dow finishing lower and the S&P 500 and Nasdaq in positive territory.

The jobs report was the story of the day. The economy added only 74,000 jobs in December, far below the 193,000 that economists surveyed by CNNMoney had forecast. The unemployment rate last month fell to 6.7% from 7%, the Labor Department said.

The market struggled for direction for most of the day, meandering between slight gains and losses. The fact that stocks didn't take a complete nosedive despite an anemic jobs report may signal that investors don't think the Fed will rush to pull back on, or taper, its massive stimulus program.

That support from the central bank has been a big driver of the bull market.

The Fed announced last month that it will cut the size of its bond buying program since data showed evidence of an improving economy.

And while the monthly jobs report is often considered the best metric for gauging the health of the economy, some analysts were downplaying it.

"Stocks are shrugging off any fundamental economic impact from a disappointing number for just one month," said FTN Financial's Jim Vogel, adding that other recent economic data has been positive.

The economy is still improving and one unemployment report doesn't change that, according to David Lutz of Stifel Nicolaus,

He believes traders are looking at the jobs number and feeling comfortable that the Fed won't increase the size of its taper anytime soon. The Fed is now buying $75 billion a month in bonds, down from $85 billion previously. There had been expectations that the Fed would keep cutting the size of its bond purchases by $10 billion or so at its next few meetings. That is no longer certain.

Yields on the 10-year Treasury note fell as investors bought more bonds. (Rates and prices move in opposite directions.) That's another sign the market is betting that the Fed will act more cautiously.

"It's a total taper play," Lutz said of the market's reaction.

Related: Fear & Greed Index still shows greed

What's moving: Target (TGT)shares were under pressure after the retailer said 70 million individuals had information stolen in the recent data breach of credit and debit cards.

"nice job $TGT -- you've handled this fiasco as poorly as you possibly could," quipped StockTwits trader 1nvestor.

The breach announcement came just hours after Goldman Sachs gave Target a "buy" rating and forecast sharp earnings growth for the retailer in 2014.

One StockTwits user thought that an upgrade of Goldman Sachs upgrade would help Target, despite the hacking news.

"will go green," said mytfine. "Must support the upgrade."

But that hasn't happened yet.

Alcoa (AA) shares sank, one day after the aluminum producer reported quarterly earnings that missed estimates.

But StockTwits trader chaku is optimistic about the stock and shrugged off the downward move.

"$AA this is going to rise again.. very common to see panic," he said.

Sears (SHLD) shares plunged more than 13% after the retailer reported a big drop in same-store sales during the holiday season and issued a weaker-than-expected forecast.

"$SHLD Sears enter Death Spiral..might bankrupt by 2017," said StockTwits user BlessMe.

Abercrombie & Fitch (ANF) shares surged 12% after the clothing retailer raised its earnings guidance for the year.

But StockTwits trader FedGamer felt some profit-taking was in order.

"$ANF He who sells and runs away, lives to sell another day," he said.

European markets finished mostly higher, while Asian markets closed with mixed results.

--CNNMoney's Annalyn Kurtz contributed to this report