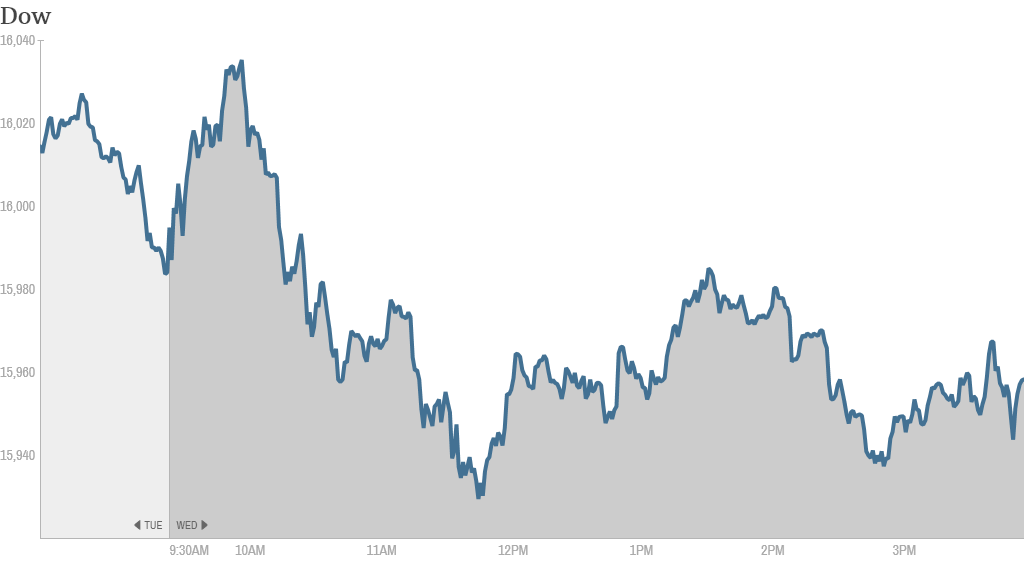

Stocks ended mixed Wednesday, as investors took a breather following a four-day winning streak.

The S&P 500 finished just below the breakeven line, while the Dow also closed in the red, as a slump in shares of Procter & Gamble (PG) weighed on the blue chip index. The company cut its sales and earnings guidance for the year due to the devaluation of emerging market currencies.

The Nasdaq managed a fifth up day, but the gain was slim.

The modest moves follow Tuesday's huge rally, sparked by the realization that the Federal Reserve's monetary policy is unlikely to change much under new Fed chair Janet Yellen.

In testimony before the House, Yellen said the Fed will continue reducing its stimulus as the economy gradually improves. She added that recent emerging market turmoil posed no real risk to the economic outlook for the United States.

"Janet Yellen managed both to make it clear that the Fed intends to stick to its current path of gradually slowing the pace of bond-buying, and to sound suitably dovish about the outlook for wages, inflation, and monetary policy overall," wrote Kit Juckes of Societe Generale, in a report.

Concerns about emerging markets have also begin to fade a bit thanks to surprisingly robust January trade data from China.

Progress towards a debt ceiling deal in Washington helped lift sentiment as well. The House voted late Tuesday to raise the limit on U.S. borrowing for a year, and the Senate also approved the measure Wednesday.

Related: Fear & Greed Index no longer feeling extreme fear

On the corporate front, Cisco (CSCO) was in focus as investors anticipated the company's quarterly earnings. After the bell, Cisco reported profits and sales that were slightly higher than Wall Street's expectations, and also raised its quarterly dividend.

Leading up to the earnings release, Cisco shares finished the day slightly higher after being the only Dow component to end in the red Tuesday, despite the market's broad rally. The stock was flat in early trading after hours. Shares are likely to move more dramatically once CEO John Chambers offers guidance during the company's conference call.

Some traders on StockTwits warned that Wednesday's gains may be unwarranted, as the company was expected to report a drop in earnings and revenue.

"$CSCO don't fall for pre-ER hype," said Eldoctoro. "Go to sidelines."

But StockTwits user sh34 thought that any bad news was already priced into the stock.

"$CSCO Earnings expectations are so low that any good news could be a pop...Bullish," he said.

In other earnings news after the bell, Whole Foods (WFM) shares fell after the company reported earnings and sales that missed forecasts and lowered its outlook.

Amazon (AMZN) shares ended sharply lower after UBS downgraded the stock to "neutral" from "buy." The online retailer also announced that it would hire 2,500 full-time workers at its fulfillment centers, in addition to the 20,000 that it hired last year. Amazon was the second-worst performer in CNNMoney's Tech 30 index.

The reaction among traders was mixed. Some predicted that Amazon, currently trading around $350, is headed even lower.

"$AMZN Blood is on the floor and everyone is smelling it," said Sammm1777. "Next stop $325?? Bearish."

But others wondered if the pullback makes Amazon a good buy.

"I've been wanting to own $AMZN for quite some time and am looking for a good entrance point," said websShawn. "Should I get aboard now or wait for lower lows?"

Trader commonsensegenius seemed to think so: "Big loss today $AMZN, great company, fat stock. The more it dives the longer it'll run, probably, so accumulate away."

Social networking site LinkedIn (LNKD) fell 5% and was the worst performer in the Tech 30 index. The stock has slumped since announcing earnings and guidance last week that underwhelmed investors.

Shares of ING Group (IDG) jumped after the Dutch bank reported significant quarterly increases in earnings. French bank Societe Generale (SCGLF) also reported a quarterly jump in profit.

S&P 500 companies DaVita HealthCare Partners (DVA) and retailer Fossil (FOSL) were also big gainers after reporting quarterly earnings that beat expectations.

European markets finished the day higher, following gains on Asian markets. The Shanghai Composite added 0.3%, while Hong Kong's Hang Seng advanced 1.5% and the Nikkei rose 0.6%.