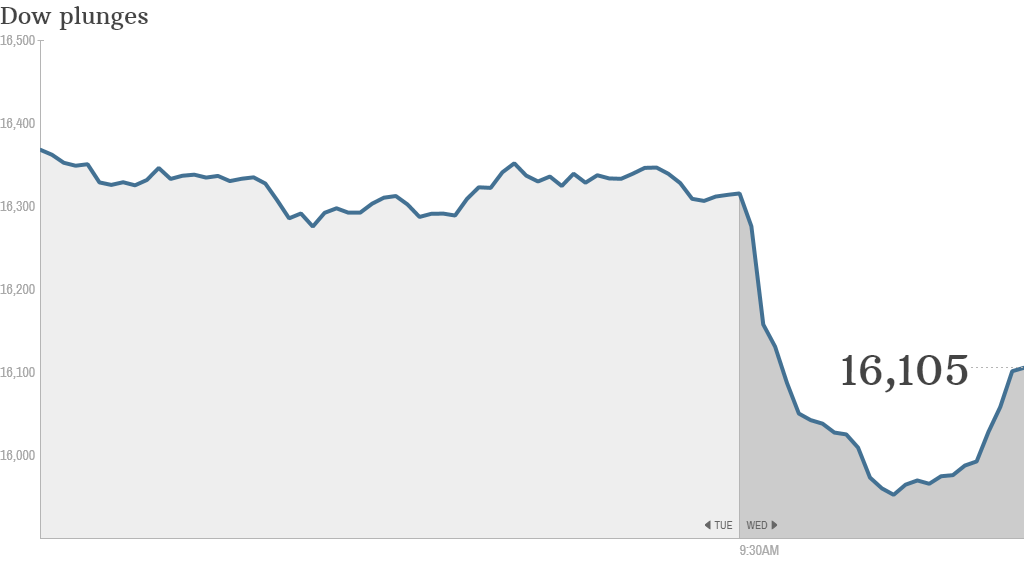

Investors are running away from stocks as fast as they can.

The Dow plunged more than 350 points shortly after the opening bell Wednesday while the S&P 500 and Nasdaq each dropped more than 2%.

Stocks rebounded later in the morning but the sell-off worsened as the day wore on. The Dow was down more than 400 points by mid-afternoon.

Strangely enough though, it seems that investors are still bullish on America in spite of the market volatility. They are doubling down their bets on U.S. Treasury bonds.

The rate on a 10 Year Treasury plunged Wednesday morning to 1.86% -- its lowest level since May 2013. Yields fall when investors are buying bonds.

The yield moved back above 2% later on during the day. So rates still have a relatively long way to go before they approach their all-time low of 1.39% from July 2012.

Bond investors do the safety dance. So why the heck is everybody rushing into bonds?

One word: Security. The United States still seems to be holding up better than Europe and Japan. Concerns about China's economy losing steam are also making the U.S. look more attractive.

Related: The stock market scare: 3 key numbers to watch

And with worries about Ebola and ISIS roiling the stock market, traders need someplace to put their money -- besides burying it in the backyard or sticking it under a mattress.

"Lower rates are not a result of fears about the U.S. economy," said Michael Arone, a chief investment strategist for State Street Global Advisors. "This is a flight to safety. Investors had been much too complacent until recently."

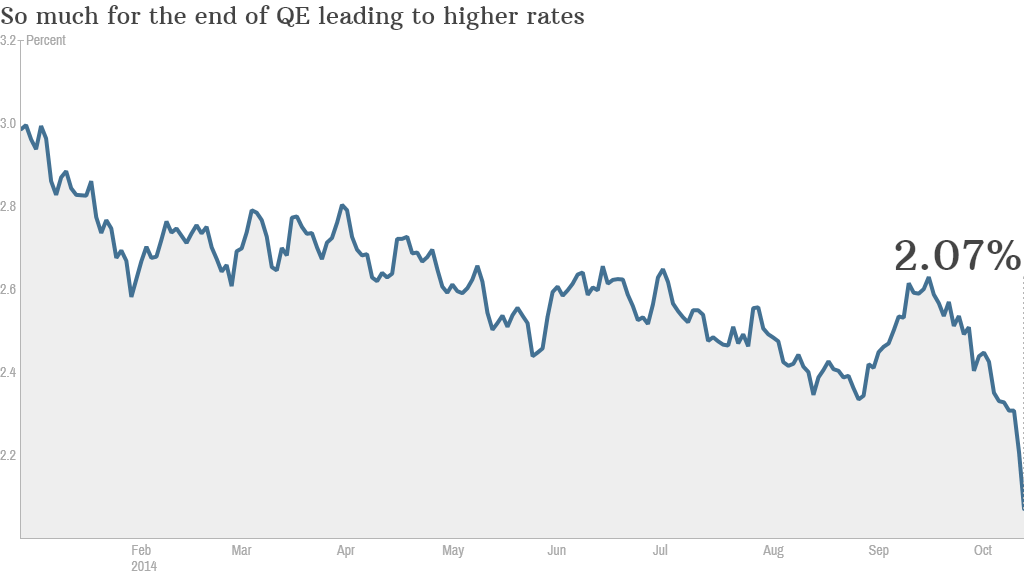

The big drop in rates is a bit curious though given that the Federal Reserve is about to end its long-running bond purchase program, a policy known as quantitative easing or QE.

At the beginning of the year, many experts thought that the 10 Year Treasury could finish 2014 with a yield of more than 3%. Some thought 4% wasn't even out of the question once QE was over.

What appears to be happening is that foreign investors are still buying massive amounts of U.S. debt. China and Japan each hold more than $1 trillion in U.S. Treasuries.

Could rates fall even further from here? Yes.

But the bottom would probably have to fall out of the U.S. economy for Treasuries to hit a new record low.

Low rates aren't always a good sign. Keep in mind that while rates are extremely low in the U.S., they are even lower in other developed markets. France's 10 Year yields just 1.2%. Germany's 10 Year is yielding 0.84%. Japan's benchmark is below 0.5%. This is not because investors love the economic conditions in Europe and Japan. It's the opposite. Investors are worried about deflation.

So if you believe the U.S. economy is not heading into a recession, rates should head higher. A general rule of thumb is that higher rates go along with stronger economies.

"Bonds are a place where people are trying to hide today. Investors have been chased into them," said Keith Trauner, co-manager of the GoodHaven mutual fund (GOODX). "Even if there is more fear in the world in the short-term, betting on lower rates for a sustained period of time is likely to be a bad move."

Trauner said that investors may be duping themselves into thinking that bonds are a safe, stable bet. He said rates should head higher once the recent market turmoil is over and used a popular joke on Wall Street to describe the high-risk and low-reward nature of bonds.

"It's like picking up pennies in front of a steamroller," he said.

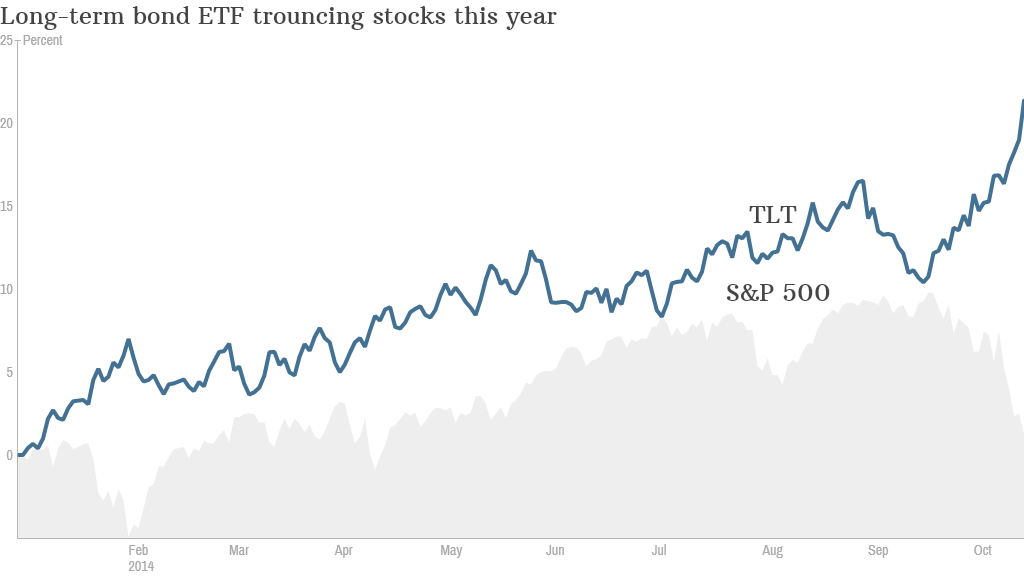

Still, people have been declaring the end of the bond bull market all year. And they've been consistently wrong.

"U.S. Treasuries have been the number one asset to own this year by a long shot," said Paul Karos, senior portfolio manager for Whitebox Mutual Funds. "Who would have thought government bonds would outperform stocks by this much?"

Good news for consumers? But regardless of whether or not bonds are still a good investment right now, consumers may benefit from the continued decline in long-term rates.

For anyone lucky enough to be able to get approval for a loan, you can expect mortgage rates to keep falling along with the 10 Year.

Bob Baur, chief global economist for Principal Global Investors, said it's possible that the combination of cheaper credit and lower oil and gas prices that are another byproduct of the global market turmoil may help fuel the economy in the fourth quarter.

"The U.S. economy is still in good shape. The drop in mortgage rates is very positive," Baur said. "There could be a little boom-let here. The decline in stocks does not look like a harbinger of recession right now."

Related: German economy hurt by Russia-Ukraine crisis

But will that still be the case if stocks and bond yields keep falling? Arone conceded that at some point, investors may view the drop in U.S. bond yields as a sign of global economic malaise partially caused by the strong dollar. The dollar's rally has made it tougher for European consumers to afford American-made goods.

So a tipping point may soon be reached. Low U.S. bond rates will be something to fear instead of cheer.

"U.S. economic data has been strong lately. Housing, auto sales and manufacturing are all solid," Karos said. "But can it last?" The rest of the world needs to turn around or the U.S. will drift lower."