For one day at least, Wall Street remembered that earnings matter.

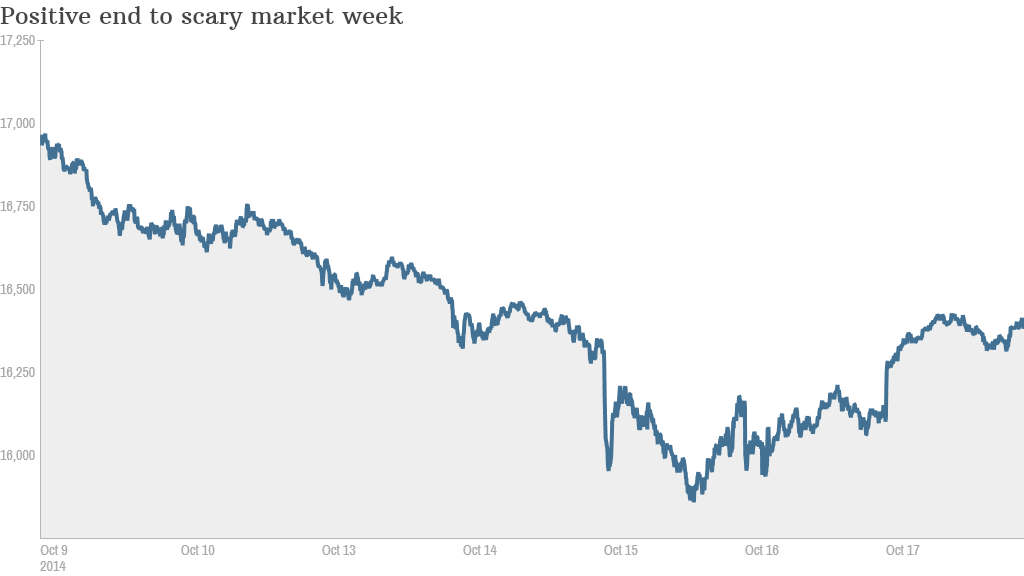

Stocks are storming higher Friday. The Dow rose 263 points, or 1.6%, its second best day of the entire year. Meanwhile the S&P 500 and Nasdaq each finished about 1% higher, and European markets rallied as well.

Strong results from General Electric (GE), Morgan Stanley (MS) and Honeywell (HON) put traders in a good mood for the first time in more than a week. Also helping: investors continue to hold out some faint hope that the Federal Reserve may keep the easy money party going just a little bit longer.

While Friday's rebound is optimistic, stocks are still down heavily for October. This is the fourth week in a row that the Dow has closed with losses, and the tech-heavy Nasdaq index is down over 5% this month.

The doom and gloom from Europe (especially Germany) and Ebola remain. Even China is showing signs of slower growth. There's concern they could drag the U.S. economy down.

James Bullard, president of the St. Louis Fed, told Bloomberg News on Thursday that the Fed should weigh delaying the end to quantitative easing, or QE. The bond-buying experiment has helped send stocks to record highs, but it was set to end this month.

The reality is the Fed can't do much right now. Interest rates are at historic lows near zero. Europe went so far as to cut interest rates to negative levels this year, but that has done little to stimulate the economy there. Investors understand that when a central bank takes such dramatic actions, it's a sign of big trouble.

Related: Can you protect yourself from a market crash?

"I view the probability of the final QE3 winddown being delayed as somewhere between 0 and 1%," wrote Tim Anderson, managing director of MND Partners, in a morning note. "The market is already set up for a decent bounce, a high ranking Fed member basically says 'If this gets really bad we'll be there.'"

What's next? What can really turn this market around isn't the Fed, it's strong corporate earnings. Investors need to focus on whether or not companies are growing.

There were positive signs Friday morning. And there's a slew of earnings coming in the next two weeks, including big names such as Apple (AAPL) and Coca-Cola (KO). If those business "report cards" are mostly positive, it's likely to put traders and investors at ease.

A lot of strategists believe the U.S. economy is still growing and companies are sitting on a lot of cash, which helps them get through any rocky periods and enables them to invest in new equipment and programs.

"Various indicators suggest that the U.S. is about halfway through what should rival its longest expansion ever," Chris Hyzy, U.S. Trust's chief investment officer, wrote in a report this week.

On the upside, unemployment is back under 6% and jobless claims came in this week at the lowest level since 2000. According to figures released Friday, Consumer Confidence hit its highest level in seven years this month, although the reading was taken before the worst of the market dip.

There's an easy case to make that October, while scary for stocks, could turn out to be a blip in a long bull market.