The stock market roller coaster is back.

The Dow and S&P 500 shed over 4% in December before rebounding sharply this week. Take your pick of what to be most concerned about: cheap oil, a flat-lining Europe, a slowing China, Russia on life support, the Federal Reserve taking away the stimulus punch bowl or terrorism.

So what should you do with your money?

Long-term investors -- those of us with money in the market for retirement or other far away needs -- are told to sit tight. Trying to time the market typically leads to a far worse outcome than keeping your money invested.

Related: Who loses if Russia implodes?

It's great advice, except for one big caveat: Investors need to do an annual check up.

"For long-term investors, you stick with your game plan and don't get rattled. But not getting rattled doesn't mean you should never change your allocation," says Russ Koesterich, chief investment strategist for BlackRock.

Only 10% of people who have a 401k plan at Fidelity made any changes to their portfolio in the 12-month period ending in September.

To put that another way, 9 out of 10 people are doing an exceptional job of "sitting tight" on their investments.

But here's the problem: We have had several years of incredible stock market gains. It's been a lot of fun getting those retirement statements in the mail and seeing the amount increase year after year since the market bottomed out in March of 2009.

Related: No one is smart enough to time the market

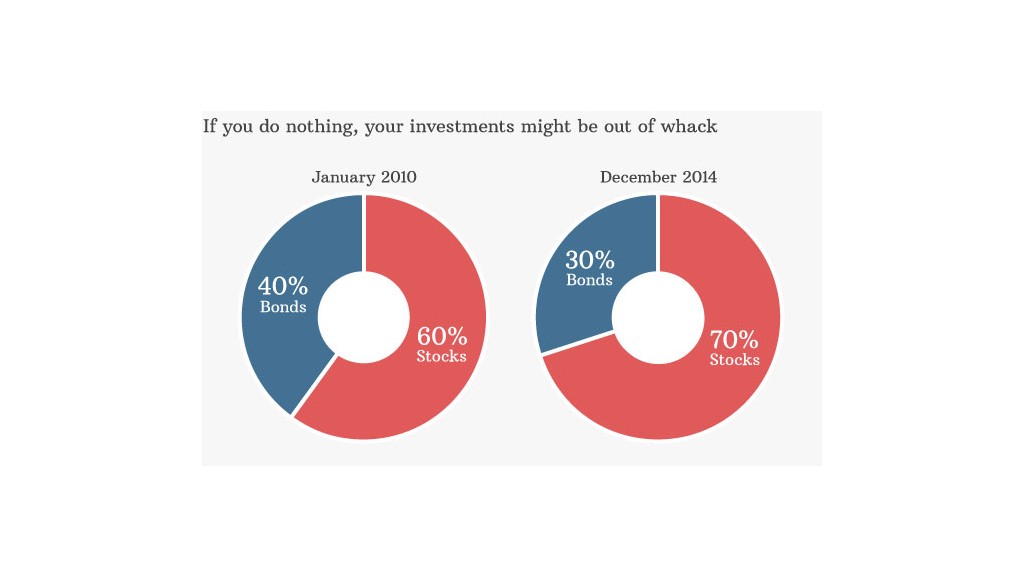

But it's likely caused your asset allocation to get out of whack. Take a typical "60/40" portfolio with 60% of investments in stocks and 40% in bonds. That's a pretty common asset mix for someone nearing retirement.

If you started with that 60/40 mix five years ago and you haven't touched it, you now have about a 70% stocks/30% bonds portfolio, according to a CNNMoney analysis using S&P 500 returns and a U.S. government bond fund.

That's a very different asset mix. It's weighted much heavier into stocks than before and is therefore a lot riskier.

As the market gets choppier, you probably want to make sure you've get back to the right portfolio allocation to meet your long-term goals. That likely means you need more bonds and less equity.

"As we've seen in the last month as portfolios have gotten hit by oil prices, people are reminded, 'Oh yes, that's why I have the stability of bonds in my portfolio,'" says John Sweeney, executive vice president for Retirement and Investing Strategies at Fidelity.

What's ahead for 2015: CNNMoney's survey of investment experts forecasts that stocks are likely to increase in 2015, but only modestly. And many of these market pros noted that the risks are rising.

Related: Why $55 oil is scaring the stock market

Recent market conditions don't mean you freak out and go all into cash, but they are a good reminder that now might be a wise time to look at whether you should increase or decrease parts of your portfolio.

In the investing world, this annual check up is often referred to as "rebalancing."

"Periodically -- once a year -- you want to go back and make sure your allocations are in line with your long-term goals," says Koesterich. "Otherwise you are taking on bets you didn't intend to take."

The other option that a growing number of Americans are opting for is putting their money into a "Target Date" fund. This is where you select a fund based on your age and likely retirement year and then your 401K manager takes care of the rebalancing between stocks and bonds for you.

Calculator: Will you have enough to retire?

In your 20s, your portfolio manager likely has your Target Date fund positioned very aggressively -- up to 90% -- in stocks. But as you age, the fund manager decreases your allocation to equities. By the time you retire, a Target Date fund likely has about 55% or less in equities, according to Sweeney.

More than a quarter of Fidelity's 401K assets are now in Target Date funds, Sweeney notes.

"The worker is assured the asset allocation is correctly allocated over their career," he says.