The Federal Reserve said it will remain "patient" and not rush to boost interest rates. But the writing is on the wall. Rate hikes are coming sooner rather than later.

The central bank sounds very upbeat about the U.S. economy. It cited evidence that the economy is getting stronger, especially the job market.

Perhaps even more telling is that the Fed dropped the term "considerable time" it has been using to describe when it will start to hike rates. It even hinted that if the economy improves faster than expected, the market should be prepared for a rate hike "sooner than currently anticipated."

The Fed has not changed interest rates since cutting them to near zero in December 2008. So investors are obsessed with trying to pinpoint when the Fed will finally raise rates.

The general consensus from economists and investment strategists is that the Fed will do that this summer. Michael Gapen, an economist with Barclays, said that the Fed is still in a "wait-and-see mode" and that the first rate hike will likely take place in June.

Related: The big debate: How healthy is the U.S. economy?

Market reaction: Stocks were up slightly ahead of the Fed announcement but lost those gains after the statement was released. The Dow, S&P 500 and Nasdaq fell steeply into negative territory with the Dow slipping nearly 200 points.

Mike Arone, a chief investment strategist with State Street Global Advisors, said investors may have been hoping the Fed would be less optimistic about the economic outlook. That might have bolstered the case for pushing rate hikes to the end of this year or even 2016.

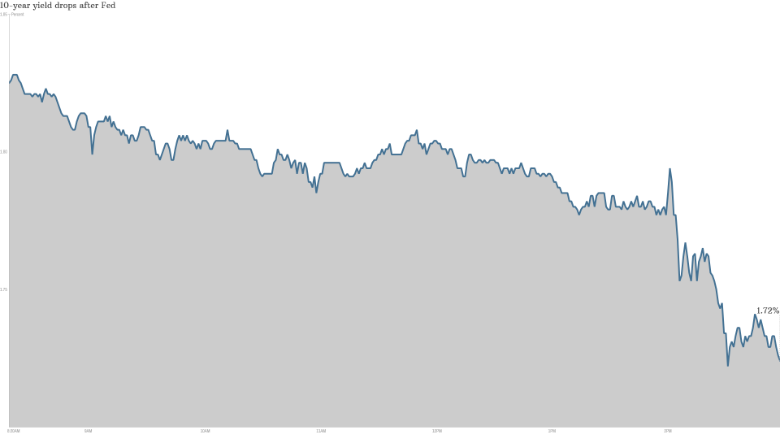

The yield on the 10-Year Treasury bond dipped as well to 1.72%, a sign that many investors around the globe are still attracted to the safety of American debt. (Yields fall when investors are buying bonds.)

Still, stocks and bonds have been extremely volatile for the past few weeks as investors grapple with the question of what the big drop in energy prices mean for the market and global economy.

Related: Market bears warn we are on the verge of a crisis

The big debate on rates: Lower gas prices should be good news for consumers. That's been the party line from Fed chair Janet Yellen and several other policy makers.

In addition, last year was the best one for job seekers since 1999. That's key because maximum employment is one of the Fed's goals.

So if the unemployment rate continues to fall and consumers keep spending, the Fed should have no problem sticking to its plan to raise interest rates at some point later this year.

But the decline in oil prices may be evidence of weakening demand across the globe. Inflation is very low in the U.S. as well. There are even some worries about deflation, particularly in Europe.

Those might be reasons for the Fed to hold off on any rate hikes. Price stability is the Fed's other mandate.

"If the Fed does start to lift rates in the current environment, it would be viewed as a negative to financial markets," said Patrick Maldari, senior fixed income specialist at Aberdeen Asset Management. He added that deflation might still be a "greater risk" than inflation.

But the Fed continued to stress that it thinks the decline in energy prices is temporary. It reiterated that its longer-term inflation expectations have "remained stable."

Still, the Fed acknowledged the turmoil in the global markets. It said "international developments" were one of the many factors it was monitoring. The Fed did not say that in December.

Making matters more complicated? The Fed is trying to figure out the ideal time for a rate hike just as the European Central Bank is starting to buy a massive amount of bonds.

Related: 3 reasons why the ECB stimulus matters

This so-called quantitative easing policy is the ECB's attempt to lift Europe's economy out of a big hole.

That should sound familiar to Americans. The Fed used several rounds of QE after the 2008 financial crisis and finally ended the program last year.

The combination of easing by the ECB and expectations of higher rates from the Fed have helped push the euro to a more than a decade low against the U.S. dollar.

Related: Europe is on sale for American travelers

That's awesome news if you plan a trip to Italy, France or Spain soon. But the stronger dollar is another headache for the Fed since it's wreaking havoc on the market.

Stocks plunged on Tuesday after Caterpillar (CAT), Microsoft (MSFT) and Procter & Gamble (PG) said the strong dollar could hurt their profits this year.

Fellow blue chips IBM (IBM) and Johnson & Johnson (JNJ) have issued similar warnings.