While most of America welcomed the news Friday that U.S. unemployment is at a 7-year low, Wall Street freaked out.

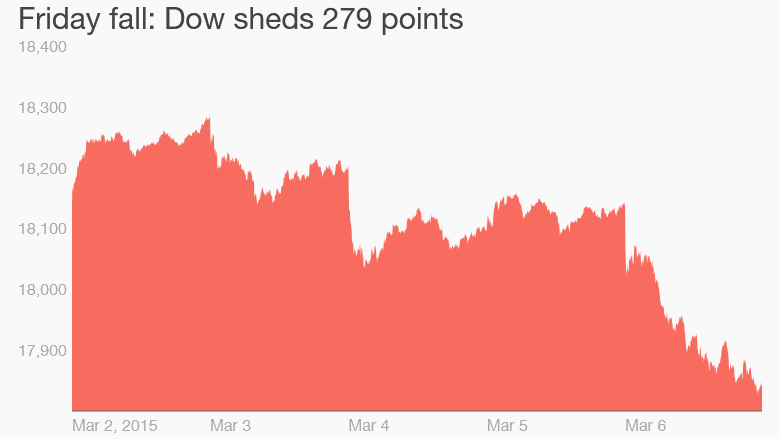

The Dow tumbled 279 points Friday and the S&P 500 shed 1.4%.

That's a lot of jitters for a market that just a few days ago was on a massive upswing. On Monday, the tech-heavy Nasdaq crossed 5,000 for the first time since the height of the Dotcom Bubble 15 years ago.

It's quite a different mood today.

It's not that investors don't like good news. More people back at work means more Americans are likely to shop and spend more. That's a positive for the economy...and stocks.

But there's just one problem for Wall Street: All this strong news about the economy means the Federal Reserve will likely raise interest rates sooner rather than later.

Related: Unemployment falls to 5.5%

Investors are nervous about the Fed raising interest rates from historic lows. They've been near zero since the financial crisis hit in the fall of 2008.

It's been dubbed a period of "easy money," and stocks have enjoyed a six-year rise thanks in part to the Fed's policies. It's been easier for companies to borrow money cheaply, and investors have been pushed to put their money into stocks since they are earning almost no interest by keeping money in the bank.

There's concern about what happens when that easy money gets harder to come by.

When will the Fed raise rates? More and more signs now point to a June rate increase.

"Given updated labor market conditions, we expect the probability of the Fed lifting policy rates in June is now 55%," wrote BlackRock portfolio manager Rick Rieder.

The U.S. economy added 295,000 jobs in February. That's the twelfth straight month we've added more than 200,000 jobs, which is considered a strong benchmark of growth. The unemployment rate fell to 5.5%, its lowest level since May 2008.

Overall, economic growth is also picking up with the Fed predicting the U.S. economy will expend even more this year.

In yet another sign that Wall Street is betting the Fed will raise interest rates soon, the yield on 10-year Treasury bonds rose to 2.25% today -- the highest level so far this year.

Is a rate hike really a problem? The real question for smart investors is whether all this panic over a Fed rate hike is warranted.

After all, part of the reason the Fed is raising rates is because the economy is improving. It's akin to taking the training wheels off of a bike. You want to get back to that "grown up" economic state.

Related: 6 stocks to buy and hold for the next decade

"We strongly suggest that Fed rate normalization will not only be borne well by the economy, but that it may actually hold a positive impact," Rieder argues.

The Fed has been saying the same thing.

"Our confidence has improved. When we raise rates, it will be a signal of confidence," Fed chair Janet Yellen said in her recent testimony before Congress.

But the stock market is overdue for a correction -- a drop of 10% or more. That hasn't happened since October 2011.

Investors don't like uncertainty. And right now, the risks feel like they're rising.

Consider that all 10 sectors in the S&P 500 were negative today. The worst performer was utilities -- down 3% -- while the least hit was financials. That's because banks could benefit the most from a Fed rate hike, while utilities and their high dividend payouts look less attractive when rates go higher. Investors are nervous that the Federal Reserve could raise interest rates as soon as June.