Here's a short summary of the week on Wall Street: Rally. Panic. Yawn. Rally again. Panic some more.

Unfortunately for investors, the losses on Tuesday and Friday were greater than the gains on Monday and Thursday.

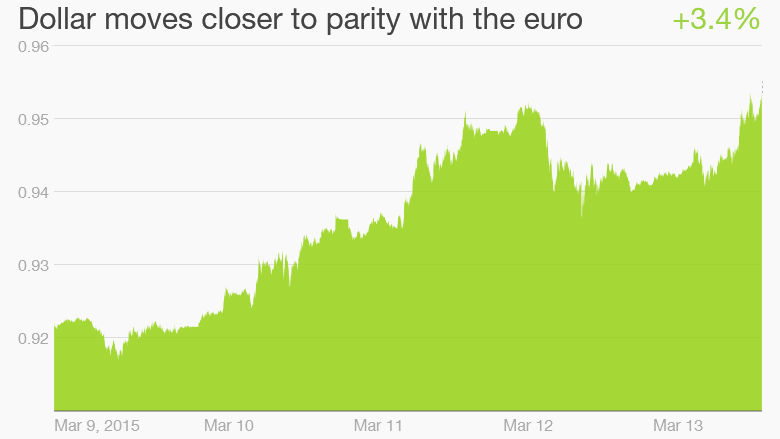

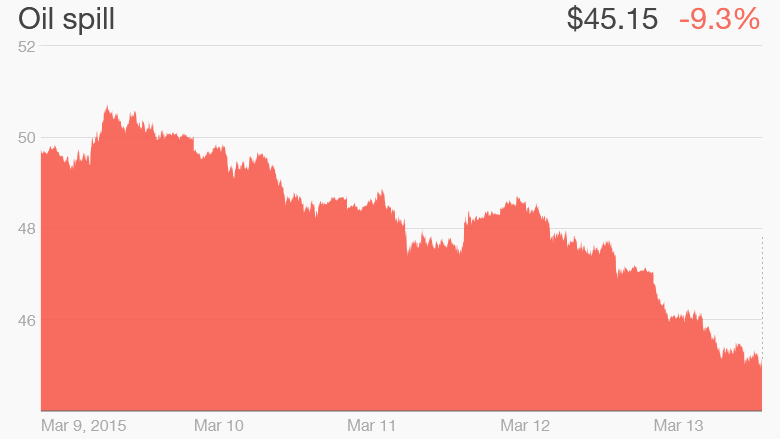

The Dow, S&P 500 and Nasdaq finished the week down between 0.6% and 1.1%. Plunging oil prices and a resurgent dollar are the big reasons behind the slump.

Stocks have been on a maddening path so far this year, plunging in January and soaring in February before heading back south this month. The Dow and S&P 500 are now negative for the year.

Volatility is back with a vengeance. Wall Street's most well-known measure of market unease, the CBOE Volatility Index or VIX (VIX), is up 5% this week and 20% this month.

CNNMoney's Fear & Greed Index, which looks at the VIX and six other gauges of sentiment is once again showing signs of Fear. It was in Greed mode just a week ago.

Related: Kid stumps Disney's CEO with question

What's an investor to make of all this?

End of the profit party? The strength in the dollar has been blamed for much of this week's sell-off. The euro is at a 12-year low versus the dollar.

A stronger greenback should hurt the profits of big multinational companies that generate a sizable chunk of their sales overseas.

They get hit two ways. International sales are lower once they are translated from weaker currencies back to American dollars. And a robust dollar makes it harder for U.S. companies to compete abroad. The prices for European and Japanese goods are going to be cheaper than American exports.

Related: The pros and cons of a strong dollar

Add the oil market's crude awakening to the mix and the corporate earnings picture gets even uglier.

Energy companies have already started to cut back on production and lay people off. But their profits should fall further if oil keeps sliding.

Crude prices were down 4% Friday and nearly 10% this week. They're back near $45 a barrel -- very close to the low point from January.

Economy is a mixed bag. The flip side to this is that the strengthening dollar and drop in oil prices should be great news for consumers.

A healthier dollar makes it cheaper to travel abroad and buy imported goods. The impact of lower gas prices is pretty obvious.

But consumers don't seem to be taking advantage of the lower prices. Retail sales have fallen for the past three months. The last time that happened was July through September 2008.

Related: The bull market is six years old. Now what?

Now things don't appear to be that bad. The results of this month's bank stress tests seem to indicate that we don't have to worry about Lehman Brothers 2.0.

The recent decline in retail sales could be attributed to the drop in oil and gas prices. Lower prices = smaller dollar amounts for sales.

The awful winter weather could have played a role too. Consumers may also just be more thrifty now. The savings rate hit 5.5% in January, the highest level since December 2012.

Still, it's not encouraging to see consumers sitting on their wallets.

Related: 3% raises may return in 2015

If they are waiting for wages to pick up, then help may soon be on the way. The job market continues to rebound and there are signs that salaries should soon climb.

But if consumers are holding off on spending because they think prices will fall further, then that's deflation at work. That's not good. It can cause the economy to go into paralysis.

Your move, Janet Yellen. And that brings us to next week's big event: a meeting from the Federal Reserve's policy makers.

The Fed will issue a statement on Wednesday. Investors will be looking for clues about when it will raise interest rates as well as any commentary on the dollar, oil and all the recent economic data.

The Fed could signal a June increase is in the cards if it removes the word "patient" from its statement. The Fed also will be releasing new economic projections Wednesday. If it doesn't cut its outlook for inflation or economic growth, that could be viewed as another sign that a rate hike is imminent.

Related: Stop crying about Fed rate hikes!

And Fed chair Janet Yellen is holding a press conference as well, although she's unlikely to tip her hand too much.

Needless to say, investors right now are just as data dependent as the Fed is. So don't expect the market's wild gyrations to end anytime soon.