Remember all those worries about earnings and the economy that caused a big slump on Wall Street last week?

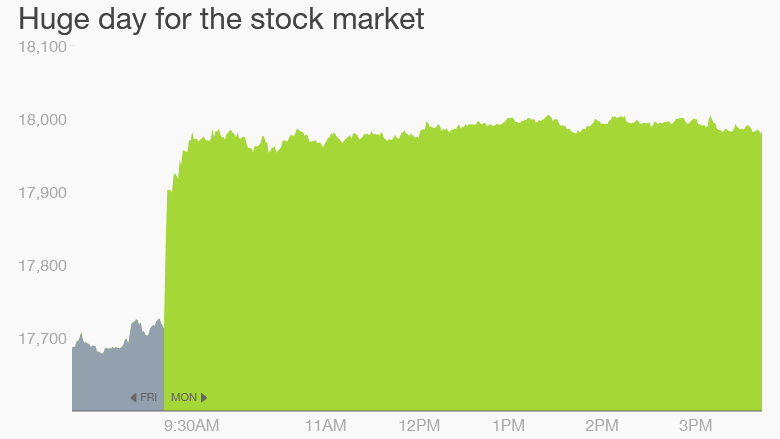

Yup, investors have forgotten all that. The market is back in rally mode. The Dow rose more than 260 points Monday, or 1.5%. The S&P 500 and Nasdaq both rose more than 1% as well.

Here are three reasons why it was something that Susanna Hoffs would call "just another manic Monday."

1. The Fed is going to take things slow. Federal Reserve chair Janet Yellen got traders in a festive mood late Friday.

In a speech released just 15 minutes before the market closed, Yellen made it painstakingly clear that she does not think the United States economy is anywhere close to its full potential.

She said that the economy should be "booming" if things were back to normal and that there was "some way to go" before the labor market was back to full employment.

Related: Janet Yellen says U.S. economy is not good enough yet

That strongly suggests that Yellen and the rest of the Fed are highly unlikely to raise rates dramatically this year. The Fed is probably going to take baby steps as it lifts rates from near zero.

Investors who were worried the Fed would jeopardize the economic recovery and six-year market rally by hiking rates too quickly can breathe a huge sigh of relief.

Share your story: Have you ever received bad financial advice?

2. Merger mania. Mergers always tend to brighten the mood of investors, and several deals were announced Monday morning.

The highlight of Monday's merger wave was health insurer and Dow component UnitedHealth (UNH) agreeing to purchase pharmacy benefits manager Catamaran (CTRX) for nearly $13 billion. There were three other healthcare mergers on Monday as well.

Investors were still contemplating the possibility of Intel (INTC) doing its largest acquisition ever too. There were reports late Friday that it was looking to buy chip company Altera (ALTR). Both stocks fell Monday as a deal has yet to materialize. But many other semiconductor stocks were rallying.

Related: Kraft and Heinz to create food giant

And all this follows the big food merger last week. Heinz, controlled by Warren Buffett's Berkshire Hathaway (BRKB) and private equity firm 3G Capital, is buying Kraft (KRFT).

3. China stimulus. One of the biggest worries that investors have dealt with this year is the possibility of a hard economic landing in China.

The Chinese economy is slowing. But China's government is taking steps to soften the impact.

The most recent initiative was the unveiling of plans to spend a lot more on infrastructure in order to promote more trade between China and Europe and Africa.

This so-called modern "Silk Road" could lead to billions of dollars invested in railroads, ports, oil pipelines and other transportation equipment.

Related: China's factories slump amid growth concerns

China's central bank has already cut interest rates twice since November. So if China is able to keep its economy from losing too much steam, that's good news for the rest of the world.

Can the rally last? it's important to note that not much has changed in the past few days.

Earnings are still likely to be weak in the first quarter. Oil prices are still low. The Greek situation remains unresolved. The Fed is going to raise interest rates.

Related: Earnings are going to stink

Stocks have been extremely volatile this year and that is likely to continue. Big mutual funds and hedge funds may also be making moves to dress up their portfolios at the end of the first quarter.

And trading volume may be light this week since there are not many key earnings and economic reports scheduled.

What's more, the stock market is closed for Good Friday -- even though the latest jobs report is coming out that day. So while Monday's rally is a nice way to start the week, don't get too excited yet.