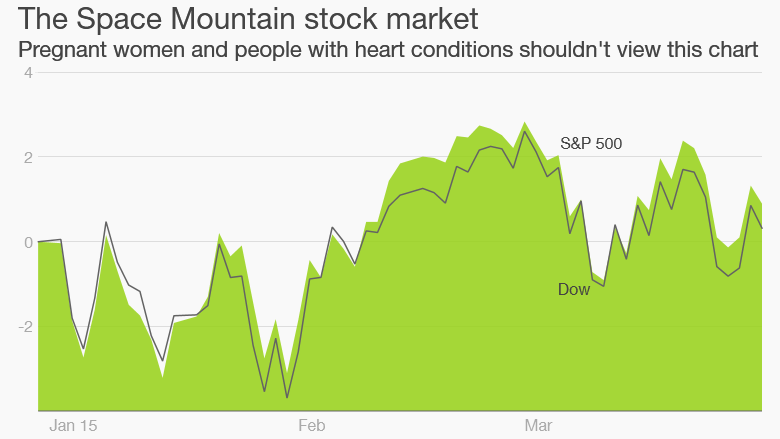

The stock market is ending the first quarter pretty much where it began the year. But it's hardly been a boring three months.

The Dow fell nearly 3.7% in January, surged 5.6% in February and is down about 2% this month. The S&P 500 and Nasdaq have gone through similar sentiment swings. The Dow ended the quarter slightly in the red while the S&P 500 and Nasdaq were up a little bit.

Charles Schwab chief investment strategist Liz Ann Sonders summed up this volatility the best -- with a nod to U2. "Running to Stand Still: Wild Swings Taking Market Nowhere" is the title of her most recent market commentary.

What can investors expect for the rest of 2015? Probably a lot more of the same.

The case for more gains: On the one hand, stocks still look attractive compared to bonds -- especially stocks that pay handsome dividends.

Stable, if not spectacular economic growth, could be good for the U.S. market. The job market is clicking. Lower energy prices should boost consumer spending.

Have you ever received bad financial or investing advice? Tell us

Companies also have a lot of cash on hand -- and they're using it to reward investors with bigger dividends, stock buyback programs and also a flurry of mergers and acquisitions.

Why stocks could fall: But the growls of the bears can't be ignored either. Earnings growth is expected to be lackluster for the full year. In fact, profits could decline in the first quarter as the strong dollar takes its toll on companies like Microsoft (MSFT), Johnson & Johnson (JNJ), Procter & Gamble (PG) and Coca-Cola (KO).

Valuations are starting to look a little frothy again. The Nasdaq is not far from its 2000 peak and that has people worried about social media and biotech stocks possibly being a bubble. It's the best index so far this year -- up over 4% for 2015.

And even though the labor market is a lot healthier than it was a few years ago, wage gains have been stagnant. Consumer spending has been sluggish.

Related: Earnings are going to stink

So can stocks actually finish 2015 in the black? History is not on the side of the optimists.

The S&P 500 has gone up for the past six years but has never enjoyed a seven-year winning streak. It's also been nearly three-and-a-half years since the market last had a 10% pullback, or correction. We're overdue.

The big wild card? The Fed. It may all come down to the Federal Reserve. The Fed is likely to raise interest rates this year and it's unclear how the market will react once rates finally go up.

Sonders wrote that "uncertainty around Fed policy" is one of the factors behind this year's bumpy ride for stocks.

Investors should be prepared for higher rates. But they've also gotten used to being near zero since December 2008.

Rate hikes will probably be slow and small. But there is a whole generation of Wall Street professionals that have no experience investing during Fed tightening cycles: the last rate increase was in June 2006.

Related: Janet Yellen says the U.S. economy is not good enough yet

And the Fed will be going against the tide, so to speak. Central banks in nearly every other major country are lowering rates and/or buying bonds as a way to keep money flowing.

So even a tiny rate hike by the Fed may seem more significant in the face of what Europe, Japan and China are doing.

Jason O'Donnell, chief investment officer of the Bluestone Financial Institutions Fund, said that the biggest issue facing investors is that the economic picture still remains muddled.

He said there is a "tug of war" going on right now between those who think the economy is picking up steam and those worried about the lack of inflation.

Fed chair Janet Yellen has gone out of her way to stress that the Fed is as data dependent as everyone else. That makes it even harder to figure out how much the Fed is going to raise rates -- and when.

So investors should probably prepare for more volatility in both the stock and bond markets until it becomes more clear what's next for the economy and Fed.