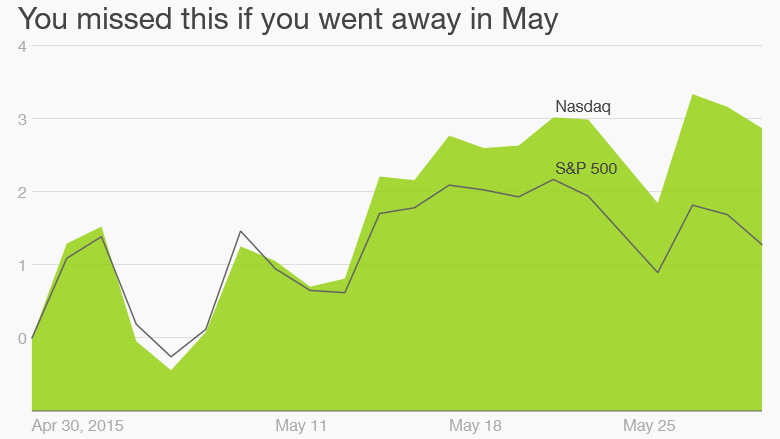

Sell in May and go away. You hear traders say that about the stock market every year.

But if you actually followed that silly piece of advice, you missed out on more gains.

Even though stocks slid Friday, the Dow and S&P 500 finished the month up 1% while the Nasdaq rose nearly 3%.

It wasn't a smooth ride up. There have been fits and starts. But these three major market indexes are all near their record highs.

Will the market continue to climb for the rest of the summer? Forget about the calendar and the supposed summer slump. The market has rallied from May through September for the past three years.

It's the economy ... Whether or not that trend continues will depend on two things: how the U.S. economy is doing and how the market thinks the Federal Reserve will react to the data.

It's no secret that the first quarter was a tough one for America. We just found out on Friday that the economy actually shrank a bit. But that's mostly due to the weather. The same thing happened last year.

The economic numbers we've seen for the second quarter so far have pointed to some modest improvement.

Related: Maybe the U.S. economy isn't tanking after all

Hiring picked up in April. The housing market recovery remains on track. Businesses are spending --- even if consumers aren't.

But it's still not clear what this means for the Fed -- which has said that it plans to eventually raise interest rates. The question is when? That's all that Wall Street seems to care about these days.

Rates have been held near zero since December 2008. So there is considerable anxiety about what will happen to stocks and bonds once the Fed finally hikes rates.

Interest rate jitters. Earlier this year, many thought the Fed would raise rates in June. Nobody believes that will happen now. The current conventional wisdom is that that a rate hike might occur in September.

But if the economy remains sluggish, it's possible the Fed could delay an interest rate move to later in the year ... or perhaps push it back to 2016.

So we might be back in a mode where good economic news is considered bad because it could push the Fed to act sooner rather than later.

Stocks took a nasty tumble Tuesday after decent economic reports sparked more rate hike fears.

Related: Janet Yellen says Fed can't risk 'overheating the economy'

That pushed up the value of the dollar -- which should rise when the Fed raises rates.

Investors have not been fans of the stronger greenback because it hurts the profits of large multinational companies like Procter & Gamble (PG), Johnson & Johnson (JNJ), Coca-Cola (KO) and Walmart (WMT). And the only E word that matters to Wall Street more than economy is earnings.

Just do it, Fed! Of course, there are other factors that traders will be watching this summer.

The latest developments in Greece and the rest of Europe. The direction of China's economy. The latest movements in oil prices.

But it all comes back to the Fed. The best thing for the market might be to finally get the rate hike out of the way.

Like many things that people dread -- going to the dentist, doing your taxes and returning that phone call from your mother come to mind -- the actual event usually turns out to be a lot less dramatic than you feared.

And at the end of the day, a rate hike is a good sign. It would show once and for all that the Fed feels the financial crisis and Great Recession are FINALLY behind us and that the recovery is for real.