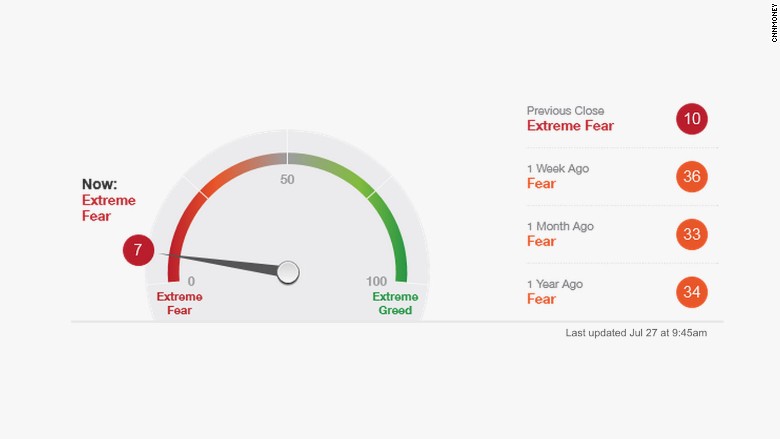

Extreme fear is back in the stock market, according to CNNMoney's Fear & Greed Index.

Just how bad is it? The index has a 100 point scale -- with 0 indicating nightmare level fear and 100 signaling "buy everything in sight" greed. On Monday, the Fear & Greed Index fell to 7.

What's especially alarming is that the index was reading 36 only a week ago. Investors were somewhat on edge last Monday, but certainly not like they are now.

The U.S. stock market is in the midst of its worst losing streak since January. Monday is the fifth straight day of losses.

The bleeding has been steady with the Dow shedding about 100 points each day. That adds up, and the Dow is now down over 2% for the year, while the S&P 500 is barely staying positive for 2015.

Related: China stocks drop 8.5% in massive rout

What's going on? Investors are spooked by the same factors that have been around for months: China's slowdown, Greece's possible exit from the euro, and the Federal Reserve's first interest rate hike expected in September.

None of this is new, but it's getting real. On Monday, China's Shanghai Composite index fell a whopping 8.5% -- its worst single day decline since February 2007. While America investors don't have a lot of exposure to China's stock market, they do have exposure to China's economy since so many U.S. businesses are now operating there.

China's economic slowdown is the bigger concern. The stock market plunge is seen as more of a warning sign to the rest of the world.

Related: China's economy is getting sick. Will it infect America?

Similarly, while the Fed has hinted heavily that it will likely raise interest rates in September for the first time in 9 years, we are now just a month and a half away.

"Despite the select group of standout winners, earnings season has been precarious. There is a serious risk that this situation will turn out to be one in which the earnings cycle has peaked prior to the Fed starting a tightening cycle," warns Mike O'Rourke, chief market strategist at Jones Trading.

Of course, momentum can change quickly in the stock market. Keep an eye on the big earnings this week from tech stocks like Twitter (TWTR) (Tuesday), Facebook (FB) (Wednesday), and LinkedIn (LNKD) (Thursday) for a read on how social media and advertising are doing. Big oil companies Exxon (XOM) and Chevron (CVX) report earnings Friday, offering another look at just how bad oil and commodities are doing this year.

Related: China's market meddling could do more harm than good

The real fear factors: But CNNMoney's Fear & Greed Index points to deeper issues in the markets beyond the headlines. There are 7 factors that make up the Fear & Greed Index. Only one of them is in "neutral," the rest are displaying extreme fear.

1. Volatility is ok. Most people keep an eye on volatility in the stock market by watching the VIX volatility index. It measures changes in S&P 500 options, so it's a good read on whether investors are buying or selling more. Volatility is up a bit in recent days, but it's still near historic lows.

2. Bonds are a red flag. Bonds have outperformed stocks during the past 20 trading days. It's close to the weakest performance for stocks relative to bonds in the past two years, and that is an indicator that people are fleeing to safety. Similarly, investors are looking twice at junk bonds. They are demanding higher and higher rates on junk bonds, which means people are more worried about risk.

Related: Find stocks expensive? Bonds are pricier

3. Lots of stocks are hitting lows. When the stock market is chugging along, lots of individual stocks hit all-time highs. That's not happening right now (Amazon (AMZN) is an exception). The number of stocks hitting 52-week lows now exceeds the those hitting highs.

Furthermore, the S&P 500 is over 1% below its 125-day average. During the last two years, the S&P 500 has typically been above this average, so rapid declines like this indicate extreme levels of fear.

4. Investors are betting on a drop. When investors think the market or an individual stock is going to go down, they buy so-called put options. We are seeing the highest levels of put buying, indicating extreme caution on the part of investors.

All of these factors are driving CNNMoney's "extreme fear" reading. Of course, the index has shown worse readings. Last October when the market tanked sharply, the Fear & Greed Index went to 0 briefly.

While it's not as bad as that, the momentum is definitely in the red for now.