Gold's glittering year keeps getting brighter.

The precious metal hit a new milestone on Monday, climbing above $1,300 an ounce for the first time since January 2015. Gold is now up 22% this year, crushing stocks, bonds and most other major asset classes.

The recent gold strength shows how the 2016 rally has really been fueled by two distinct stages. The first was a flight to safety as turmoil erupted on Wall Street and around the world, highlighted by the U.S. stock market's worst start to a year ever.

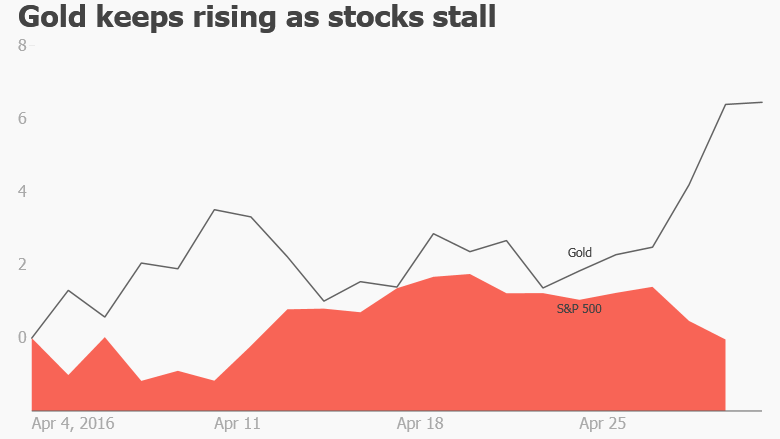

Gold prices calmed down a bit as U.S. stocks staged a massive comeback and turned positive on the year. But gold is once again on the rise, lifting the SPDR Gold Trust ETF (GLD) nearly 6% over the past month. The S&P 500 is virtually unchanged since then.

So what's fueling this latest rally? This time it's the U.S. dollar. A weak dollar is good for gold because it makes the metal less expensive for foreign buyers and reinforces gold's role as a good store of long-term value.

Related: Mining stocks soar...can it last?

The U.S. dollar has plunged 2% against a basket of currencies over the past week. That decline has helped lift gold more than 4% over that span. After years of strength, the greenback has lately been dented by the Federal Reserve scaling back its once-ambitious plans to raise rates and near-zero economic growth in the U.S.

"We had gone through such extremes of dollar strength. It was just time for the dollar to come back," said Axel Merk, founder of Merk Investments.

The dollar took a big hit against the Japanese yen just last week after the Bank of Japan shocked investors by declining to launch new stimulus efforts.

Gold has also been helped by a bit of renewed turbulence in the stock market. Last week the Dow suffered its worst week since February and the Nasdaq is in the midst of a seven-day losing streak.

Todd Salamone, senior vice president of research at Schaeffer's Investment Research, said in a recent blog post that "now might be the time" to sell gains in the stock market and increase exposure to gold. He cited the "potential for sideways action" in stocks over the next several weeks.

No matter the cause, the gold rally has been huge for gold mining stocks like Newmont Mining (NEM). Shares of Newmont have spiked 90% this year.

Related: Silver is even hotter than gold these days

But is it too late to get into gold given the recent spike?

Even the gold bulls at Capital Economics concede they are "a bit wary of the strength of the current" commodity rally and warn that a pullback could be coming. They point to the possibility the Fed will resume its rate hike plans and the U.S. dollar strengthens.

However, Capital Economics still thinks gold can end the year around $1,350 an ounce before rising to $1,400 by the end of 2017.

Merk is also staying bullish on gold, in part because he believes the U.S. stock market is in the midst of a bear market rally.

"If I'm correct and we do have the S&P 500 plunge down, gold could do very, very well," he said. "If policymakers do everything perfect and equity markets end happily ever after, we could have seen the highs in gold."