1. Fed meeting begins: The Federal Reserve kicks off a two-day meeting Tuesday to discuss monetary policy. Most investors are betting that the meeting will culminate on Wednesday with an interest rate hike.

The Fed has not raised rates since December of last year.

If the central bank does hike rates, it could lead to major moves in global stock and bond markets. But it would also indicate that the Fed believes the U.S. economy is strengthening.

"It is not the rate decision so much as the nuances around it that excite investors," noted Paul Donovan, global chief economist of wealth management at UBS. "Worrying about the Fed gives a reassuring -- perhaps false -- sense of being normal in an era of abnormalities."

2. 14,000 job cuts: Italy's UniCredit (UNCFF) has announced that job cuts at the bank will reach 14,000 by 2019, which is equivalent to about 10% of its workforce. It also plans to raise €13 billion ($13.8 billion).

This is the latest attempt by a major Italian bank to stabilize its finances.

Shares in UniCredit jumped 5% following the announcement, and helped lift the overall market index in Milan. But UniCredit shares are still down about 50% since the start of the year.

Competing bank Monte dei Paschi is also struggling to cobble together €5 billion ($5.3 billion) from private investors in an attempt to avoid a state bailout.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

3. Deal hangover: Shares in Asahi Group fell 4.6% in Tokyo as investors reacted to the company's deal to buy beer businesses from Anheuser-Busch InBev (BUD).

The purchase will expand the Japanese drinks giant's operations into the Czech Republic, Slovak Republic, Poland, Hungary and Romania. Pilsner Urquell is included in the deal.

4. Monitoring Trump's moves: President-elect Donald Trump has nominated ExxonMobil (XOM) CEO Rex Tillerson to serve as secretary of state.

Tillerson, 64, has no formal foreign policy experience, but the oil man has built close relationships with many world leaders by closing big deals on behalf of his firm.

"His tenacity, broad experience and deep understanding of geopolitics make him an excellent choice for secretary of state," Trump said in a statement.

Trump also announced overnight that he is postponing an important press conference scheduled for Thursday. The real estate magnate had promised to discuss plans to avoid conflicts of interest in the White House.

Trump owns or has a position in more than 500 companies, according to a CNN analysis.

Download CNN MoneyStream for up-to-the-minute market data and news

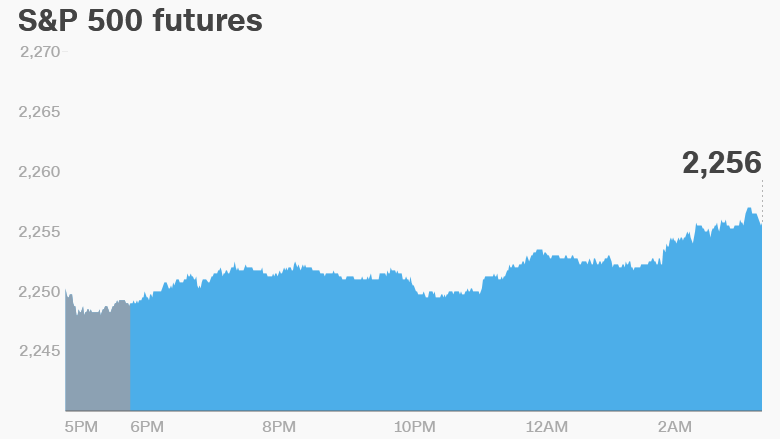

5. Stock market overview: U.S. stock futures are pushing up, putting the Dow Jones industrial average on track to hit another all-time high when trading commences.

The Dow and S&P 500 each hit all-time highs on Monday.

European markets are mostly rising in early trading and the majority of Asian markets ended the day with gains.

6. Coming this week:

Tuesday - FOMC meeting starts

Wednesday - FOMC meeting finishes with a news conference; First rate hike in a year expected

Thursday - Bank of England rate decision; Super Mario Run for the iPhone releases; Venezuela's new currency debuts

Friday - "Star Wars Rogue One" nationwide release in the U.S.