1. Big 3 to D.C.: President Trump is hosting a breakfast meeting with the CEOs of General Motors (GM), Ford (F) and Fiat Chrysler (FCAU) on Tuesday.

"[Trump] looks forward to hearing their ideas on how we can work together to bring more jobs back to this industry in particular," White House spokesman Sean Spicer said.

Executives from Toyota (TM), Honda (HMC), Nissan (NSANF) and Hyundai, which all have U.S. plants as well as plants in Mexico, weren't invited to this meeting, according to spokespeople from those companies.

Trump has been vocal about his plans to penalize companies -- specifically automakers -- that make products in Mexico and then sell them in the U.S.

2. Loads of earnings: 3M (MMM), Alibaba (BABA), Johnson & Johnson (JNJ), DuPont (DD), Lockheed Martin (LMT), Verizon (VZ) and Philips (PHG) are releasing earnings before the open.

Alcoa (AA) and Texas Instruments (TXN) will release earnings after the close.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

3. Ones to watch -- Samsung, Volkswagen, Yahoo, BT: Shares in Samsung (SSNLF) continued to push higher Tuesday after the firm reported its biggest quarterly profit in three years.

The firm's stock is trading near all-time highs even though the company has been linked to a huge political corruption scandal and has faced a public backlash for selling smartphones that overheated and occasionally caught fire.

Shares in Volkswagen (VLKAY) are holding steady after a U.S. district court in California gave final approval for the firm to pay $1.2 billion to its American car dealers for its emissions-cheating scandal.

Shares in Yahoo (YHOO) are rising a tad in premarket trading after the company reported its latest quarterly results.

The company's sale to Verizon (VZ) is now expected to close in the second quarter of this year, a delay from initial plans to close the deal this quarter.

Shares in the British telecom firm BT Group (BT) are plunging by about 18% in London after the company reported "inappropriate behavior" and "improper accounting practices" in its Italian business.

4. Court ruling on Brexit: The pound has taken a small dip after the U.K. Supreme Court ruled on Brexit.

The court ruled that the U.K. government must hold a vote in parliament before beginning the process of leaving the European Union.

The government had originally planned to trigger Brexit without a parliamentary vote.

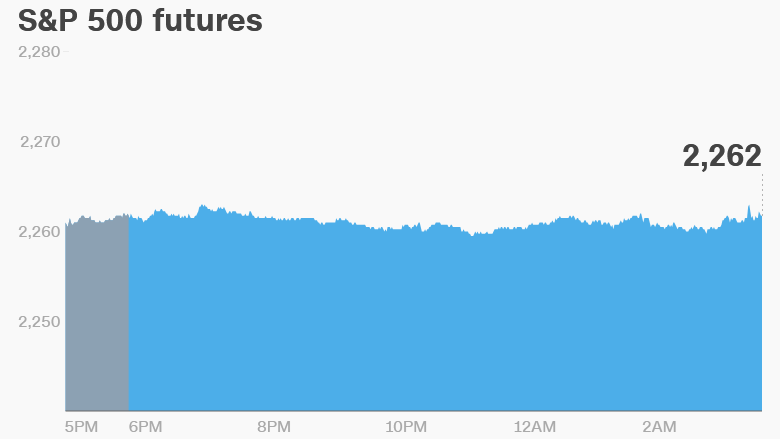

5. Stock market overview: Investors seem to be in wait-and-see mode right now.

U.S. stock futures are holding steady as most European markets edge higher in early trading.

Asian markets ended the day with mixed results.

Download CNN MoneyStream for up-to-the-minute market data and news

6. Coming this week:

Tuesday - Senate hearing to review Mick Mulvaney's nomination to be director of the Office of Management and Budget

Wednesday - Boeing (BA) and AT&T (T) earnings

Thursday - Microsoft (MSFT), Alphabet (GOOGL), Ford (F), and Starbucks (SBUX) earnings

Friday - First reading of fourth-quarter U.S. GDP