|

Bristol in patent fight

|

|

November 22, 2000: 12:58 p.m. ET

New patent may effectively delay competition to anti-anxiety drug BuSpar

By Staff Writer Martha Slud

|

NEW YORK (CNNfn) - Bristol-Myers Squibb Co. has received a new patent that effectively could protect its exclusive rights on anti-anxiety drug BuSpar for more than two years, dealing a blow to generic drug makers who hope to introduce cheaper, copy-cat versions of the medication.

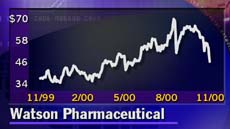

The announcement caused generic drug maker Watson Pharmaceuticals Inc. (WPI: Research, Estimates), which had planned to launch a generic version of BuSpar imminently, to slash its revenue and earnings forecasts through 2001. Corona, Calif.-based Watson had hoped to win U.S. Food and Drug Administration approval for its generic drug Wednesday, the day Bristol-Myers' patent was due to expire.

Watson's stock slid about 6 percent at midday. Shares of Pittsburgh-based Mylan Laboratories Inc. (MYL: Research, Estimates), which also was readying a generic rival, fell about 3.5 percent, and K-V Pharmaceutical Co. (KV.A: Research, Estimates) of St. Louis dropped more than 8 percent. Other generic drug makers also had hoped to get into the generic market for BuSpar, which had sales of $605 million last year.

But Bristol-Myers (BMI: Research, Estimates) threw a wrench in their plans by announcing Tuesday that it has received a new patent on a metabolite, or derivative, produced through use of the anxiety treatment -- saying that it will now research other applications of this byproduct. The new patent could effectively arm Bristol-Myers with ammunition to bring patent infringement lawsuits against generic competitors.

Bristol-Myers' move highlights the volatility of the generic drug industry, which earlier this year celebrated two major victories against two large pharmaceutical makers -- one of which was Bristol-Myers, the No. 3 U.S. drug maker.

Ivax Corp. (IVX: Research, Estimates) a Miami-based generic drug maker, earlier this year won a complex legal battle to market a generic rival to Bristol-Myers' blockbuster cancer drug Taxol. And in August, a federal court sided with Barr Laboratories (BRL: Research, Estimates) and other generic drug companies in deciding to curtail Eli Lilly and Co.'s patent on antidepressant Prozac next year. Lilly (LLY: Research, Estimates), which is appealing the decision, says the patent should extend through 2003.

Watson Chief Executive Allen Chao responded angrily to Bristol's move Wednesday, saying in a statement that the New York-based pharmaceutical giant is trying to block generic competitors from going on the market. Watson Chief Executive Allen Chao responded angrily to Bristol's move Wednesday, saying in a statement that the New York-based pharmaceutical giant is trying to block generic competitors from going on the market.

"We are currently evaluating the situation and the possible actions available to us," Chao said. "This is not the first time BMS has attempted to protect its various product franchises by impeding legitimate generic competition. We intend to aggressively pursue our rights to provide our lower-cost generic alternative to the consumer."

If Bristol's new patent is proved to be valid, the FDA could be blocked from approving Watson's generic version for up to 30 months.

While Bristol-Myers may be on shaky legal ground if it tries to defend its case in court, the company likely will succeed nonetheless in delaying generic competition for a while longer, said Rich Silver, a generic drug analyst at Lehman Brothers.

"The law enables them to do that," he said of Bristol-Myers' new patent. "If you're a company and the law says this is legitimate, then you do it."

Chicago attorney Robert Green, who has litigated cases on behalf of the generic drug industry, said Bristol-Myers' strategy is not new. Other drug companies, such as Schering-Plough Corp. (SGP: Research, Estimates) and Astra-Zeneca PLC (AZN: Research, Estimates), are using similar "metabolite patent" arguments in trying to extend the patent life of their key products, he said.

"The pharmaceutical companies have gotten smarter in their strategy of using the provisions of the Hatch-Waxman legislation (a law that governs the introduction of generic drugs) to protect their products," he said.

Watson slashes forecasts

Watson said it now expects fourth-quarter revenue to be reduced by $18 million to $20 million, and 2001 revenue to be $38 million-to-$40 million below forecasts. The company was expected to post revenue of about $612.5 million next year, according to the First Call consensus forecast of analysts, meaning the shortfall would represent a roughly 6.5 percent drop.

The revenue shortfall is expected to cut earnings per share by 10 cents-to-12 cents in the fourth quarter, and by 15 cents-to-17 cents in 2001. Analysts had expected Watson to earn 39 cents per share in the fourth quarter, and $2.36 per share in 2001, according to the First Call estimate.

Watson shares fell $3.06 to $48 Wednesday afternoon. Bristol-Myers stock gained $1 to $67.88.

|

|

|

|

|

|

|