|

| The sound of success: While most tech stocks have done little during the past year, Apple has surged thanks to hot sales of the iPod. |

|

|

|

|

|

|

NEW YORK (CNN/Money) � If you're looking for a well known tech stock that's been able to stand out this year, the pickings are slim.

There's Apple, which has surged 32 percent, and then there's, uh, well, Apple. Only three other tech stocks in the S&P 500 are sporting double digit percentage gains this year. The average loss for the S&P 500 techs is 10 percent.

It's no secret why Apple (Research) has been able to perform so well...even after its moon-shot gain of nearly 200 percent in 2004. The reason, of course, is the iPod.

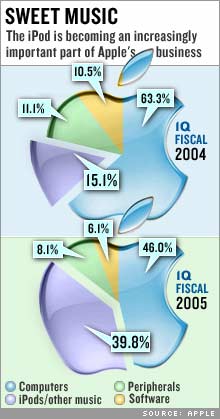

Sales of the iPod and other music related items accounted for nearly 40 percent of Apple's total revenues in its fiscal first quarter, which ended in December. That's up from just 15 percent of total sales a year earlier.

And analysts expect the iPod to continue to make beautiful music thanks to the January release of the less expensive iPod Shuffle.

Consensus estimates for fiscal second quarter results, due in mid-April, call for a sales increase of 64 percent from a year ago and an earnings gain of nearly 230 percent.

With all this in mind, can Apple's stock possibly still be a buy? After all, expectations are extremely high for the company and investors have learned the hard way what happens to momentum stocks that fail to live up to the hype.

Investors certainly need to proceed with caution but several Apple fans think that Wall Street might actually be underestimating the prospect for bigger gains ahead. And it has nothing to do with the iPod.

Crouching Tiger, hidden profits?

Apple's long-awaited update of its operating system, dubbed Tiger, should be out soon. The company has only said that it expects to release Tiger in the first half of 2005 but there has been increasing chatter among Mac devotees that it could hit the market as soon as early April. Apple was not immediately available for comment about this speculation.

Why is that important? For one, even though software sales only accounted for about 6 percent of revenues in the most recent quarter, this segment is more profitable than Apple's hardware businesses, said Shannon Cross, an analyst with Cross Research-Soleil, an independent research firm.

"Apple's software side is underreported on Wall Street but it's a big positive in terms of margin contribution," Cross said.

More important, however, could be the impact that Tiger will have on sales of Mac computers. Shaw Wu, an analyst with American Technology Research said that Tiger will spur a wave of upgrades.

Wu said that the operating system's new features, such as a desktop search function called Spotlight and the latest version of the QuickTime media playing software, could attract the interest of both the Mac faithful as well as PC-owning iPod users, a much discussed phenomenon dubbed the iPod "halo effect".

"Tiger could drive a new hardware cycle and that's pretty significant," Wu said, pointing out that despite the dramatic growth of the iPod, sales of Macs still make up nearly half of Apple's total revenues. And Macs are more profitable than iPods, said the analyst.

So even though consensus earnings estimates for fiscal 2005, ending in September, have surged 43 percent in the past three months, projections could still be too low because analysts aren't yet factoring in Tiger.

"One of the things that has gotten our interest is the fact that Apple only has a couple percentage points of PC market share. Apple doesn't need to do a lot to have meaningful gains," said Zach Shafran, manager of the Waddell & Reed Advisor Science and Technology fund. "The new operating system clearly ought to help them."

Stock's not cheap but little else in tech looks healthy

At 39 times fiscal 2005 earnings estimates, Apple stock seems far from a bargain. But if earnings estimates continue to climb, it will be harder to argue that Apple's stock looks overvalued.

And already the stock is slightly more appealing when you factor out the $6.5 billion in cash on its balance sheet. Excluding cash, Apple currently trades at 32 times estimates, a reasonable multiple given its growth rate.

"Apple isn't cheap but it's not insanely expensive. It's cheaper than many Internet stocks and it's growing as fast, if not faster than companies like Google (Research), Yahoo! (Research) and eBay (Research)," Wu said.

Cross adds that given the bleak performance of many large tech stocks this year, Apple is the only game in town for many fund managers looking for tech exposure. Fear of missing out on further gains could give the stock even more juice, she said.

"There's not a heck of a lot out there in tech that is working. From that standpoint, the question that fund managers have is, 'Where do I put my money if it's not Apple?" There are not a lot of obvious answers," Cross said.

Shafran, who owns about 2 million shares of Apple in his fund, agrees with this assessment. "There is absolutely some truth in that. To find appealing ideas in tech is very difficult to do," he said.

And since Apple has done such a remarkable job introducing innovative new products in the past few years, Shafran said he thinks he and other institutional investors are willing to bet that the company will keep wowing consumers and investors.

Apple spent 6 percent of its revenues on research and development in fiscal 2004, a greater portion than what hardware rivals Dell (Research) and Hewlett-Packard (Research) spent on R&D last year.

"Apple has been innovative and that has paid off with the iPod. Embedded in the stock price is the belief that it will continue to innovate," Shafran said.

For more on personal technology, click here.

For a look at Apple and other hardware stocks, click here.

Analysts quoted in this story do not personally own shares of the companies mentioned and their firms have no investment banking ties to the companies.

Sign up to receive the Tech Investor column by e-mail.

Plus, see more tech commentary and get the latest tech news.

|