|

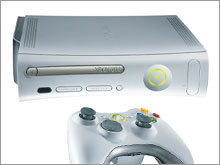

| The Xbox 360 is expected to be a big seller for the holidays. |

|

|

|

|

|

NEW YORK (CNN/Money) -

Early 2006 could bring a long-awaited renaissance for Microsoft -- and not a moment too soon for many investors.

But anyone looking for a happy surprise when the world's biggest software maker reports results Thursday may have to wait.

The Redmond, Wash.-based software company has wrestled with a stagnant stock price for years, but a round of new products due in early 2006 may fix that. In the meantime, however, it's unlikely that customers will rush to buy software that they know will soon get a major upgrade.

When it reports results for its fiscal first quarter of 2006, Microsoft (up $0.09 to $25.12, Research) is expected to post earnings per share of 30 cents on revenue of $9.78 billion, according to Thomson First Call estimates. In the year-ago quarter, Microsoft posted revenue of $9.19 billion and earnings per share of $0.27, including a stock-based compensation expense.

Investors and analysts are waiting to see whether Microsoft will beat the weakened guidance it issued for the third quarter, which sent shares lower after the company issued its second-quarter numbers.

When it reported results last quarter, Microsoft projected first-quarter revenue between $9.7 billion to $9.8 billion; at the time, Wall Street had been expecting revenue of $9.9 billion.

"I think they will exceed guidance," said Andrew Seibert, senior portfolio manager for S&T Wealth Management, a $1.2 billion, Pittsburgh-based money management firm that owns shares of Microsoft. "Microsoft and Intel have made a science out of lowering expectations so that people don't expect them to blow the roof off things."

New products may hurt, not help, in short term

Microsoft watchers will also look to see what impact next year's launch of Vista, the first major Windows operating system upgrade since XP, will have. They'll also look at the latest version of the Windows SQL Server database software, Microsoft Office 12, and the Xbox 360, due out in November.

The new products are expected to give the company's sales a jolt next year, but some worry it may hamper sales of its existing products in the short run.

Roger Kay, president of technology research and consulting firm Endpoint Technologies, said that for the fiscal first quarter, the impact likely will not be huge. Microsoft has struck deals with some computer makers allowing customers to buy machines now with the promise of a free upgrade when Vista debuts, he said.

"I think the big issues for the U.S. are going to be the server, PC and laptop unit volumes in the last quarter," said Peter Misek, senior technology analyst with Canaccord Capital, a Toronto-based brokerage and investment firm. "The guidance for unit volume growth is in the high single/low double digits -- we think they'll beat that."

The Google question

Analysts and investors are also weighing the Google question, which is less an issue for the fiscal first quarter but is nonetheless an ongoing matter for Microsoft.

Misek acknowledge that Google is working on a vast array of new projects, but he thinks that where Microsoft is concerned, investors in the U.S. are preoccupied with Google; the most stringent faction thinks Google will eventually destroy the Microsoft business model – a belief he calls "farcical."

"They are worried about a view that Google is going to offer its own operating system and deliver it by the Web, and that it will have a dramatic impact on the Windows franchise," he said. "But Google hasn't substantiated that rumor."

Gates and chief technical officer Ray Ozzie are expected to answer some Google-related questions Nov. 1, when they are expected to meet with executives from San Francisco's financial community, Misek said.

Stock still stagnant

But regardless of the big picture, investors aren't getting much comfort right now. The stock has continued to tread water this year, trading in a narrow range of about $24 to $28.

Beleaguered shareholders who haven't been able to make money from the stock at least have their dividends, but some investors think the payout could be higher. The company's next dividend, due in December, will be 8 cents a share.

For maturing tech companies, paying a dividend is the first step in admitting that you're not a growth company anymore – a painful move for some.

"It's like the 50-year-old weekend warrior who doesn't want to admit that he can't be an extreme skier anymore," said Endpoint's Kay. "There will be no more 40 percent growth; you can't get bigger at the rate you used to. If it can't reinvest, it has to do something. You can't keep cash on your balance sheet and do anything with it that people are going to be happy about."

Canaccord's Misek said he thinks the company is going to ratchet up its dividend significantly, and fairly soon.

"The cash they are generating is just accumulating," he said. "This company is generating a billion and a half to $2 billion free cash flow a month and there's a ton of cash on their balance sheet -- there's lots of dry powder here."

While Microsoft has plenty of doubters that its stock will improve significantly in the near term, Seibert is bullish on the stock and thinks that its intrinsic value is in the low $30s – and that it will get there in the next 12 months, driven in part by the launch of new products.

"Don't get me wrong -- they have some stiff competition in their space and they have to stay on the cutting edge, but I think they have the management to do it," he said. "If they don't come up with the idea, they'll buy it. They are a very strong company, it's very well run, and it has tons of cash and no long-term debt. It has a lot going for it."

-----------------------

Why aren't more tech companies paying a dividend? Read more here.

IBM to buy back up to $4b in stock: Click here.

Kay does not own shares of Microsoft and his firm has no banking ties to the company, though his firm seeks to do business with Microsoft. Misek does not own shares of Microsoft, and his firm has no banking ties to the company.

|