|

|

|

|

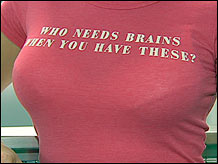

| CNN's Allan Chernoff reports on an organized 'girlcott' of popular racy T-shirts by high school women. (November 2) |

Play video

|

|

|

|

|

|

NEW YORK (CNN/Money) -

Surprise! Surprise! Surprise!

That's three months in a row now that retailers have posted strong and -- in some cases -- stellar results despite predictions that consumers' spending would wilt because of gas price woes, turbulent weather and fears of inflated heating bills in the winter months.

Didn't happen in August, didn't happen in September, and it also did not happen last month.

"Consumers are gaining momentum despite all the headwinds," said Ken Perkins, retail analyst and president of research firm Retail Metrics.

"The apparel mix in stores looks solid. Cooler weather finally gave a boost to winter merchandise and a pullback in gas prices certainly helped," he said. "You have to wonder when the consumer will be tapped out because of the negative savings rate."

Perkins said he's cautious about the first-quarter of next year. "This is when the sticker shock of home heating bills will come home to roost."

Retailers, with some exceptions, once again saw strong numbers, especially at specialty apparel stores, luxury sellers, discounters and warehouse clubs.

But, it was a mixed picture for department stores and home furnishing chains.

Wal-Mart, the No.1 retailer, delivered what it promised -- a 4.3 percent gain in same-store sales last month. Bentonville, Ark.-based Wal-Mart (Research) said food once again outpaced higher-margin general merchandise sales.

Total company sales rose $23.3 billion, up 10.5 percent from $21 billion for the same period a year earlier.

Comparable sales at its Sam's Club warehouse club rose 6.7 percent, faster than the 3.9 percent growth at its Wal-Mart stores.

However, the retailer said Sam's Club benefited from gasoline sales. Excluding gasoline sales, Sam's Club would have logged a 4.8 percent sales increase in October. Warehouse clubs including Sam's and Costco sell discounted gasoline at their stores.

For November, the company expects sales to increase between three to five percent.

"We've all been pummeled with stories about how gas went up year-over-year and is sucking away everybody's money, but the reality is more subtle," Richard Hastings, retail sector analyst with Bernard Sands, wrote in comments emailed to CNN/Money.

"Retail prices haven't budged and the value proposition has improved: better styles, better replenishments, better pricing flexibility and sharper timing of promotions," Hastings added. "Energy inflation has been offset by better retailing and changing shopper behaviors."

Rival Target Corp. (Research) continued to outperform Wal-Mart. Its same-store sales increased 5.7 percent last month, beating analysts' expectations for a 4.7 percent rise.

Teen clothiers kept their leadership position with double-digit sales increases in October. Among the winners: American Eagle Outfitters (Research)' sales surged 17.3 percent; controversial Abercrombie & Fitch (Research) said their sales rocketed 31 percent last month and Pacific Sunwear (Research) reported an 8.8 percent increase in its sales.

"Merchandising, merchandising, merchandising. Retailers with the right presentation and right combo of fresh styles and promotions hit the jackpot," Hastings said.

"Specialty retailers such as Chico's and Talbots and Abercrombie have their wardrobing and merchandising and service totally nailed down. You walk into the store and the rest is just pleasure," he said. "Sure, the weather helped, but the bedrock is merchandising expertise. Look at Wet Seal, look at Chico's, Nordstrom – it's all about trend, solutions, service, and timing."

Hot Topic (Research), the seller of Goth-inspired clothing, missed the party, posting a 5.7 percent sales decline. No. 1 apparel seller Gap Inc. (Research) also disappointed with a five percent drop in October sales.

Department store chain J.C. Penney (Research) reported same-store sales up 2.4 percent, beating analysts' forecasts for a 1.6 percent increase. Kohl's (Research) logged a solid 6.2 percent gain. Federated Department Stores (Research) saw a 0.7 percent sales decline, citing store closures due to Hurricane Wilma's impact in Florida.

Federated said total September and October sales include May department stores, which it acquired Aug. 30, while same-store sales reflect only Macy's and Bloomingdale's locations open for more than a full fiscal year.

Sales at home furnishings chain Pier 1 Imports (Research) plunged 10.4 percent, hurt in part by the discontinuation of the annual Friends and Family sales event.

|