Katrina survivors mired in taxes and red tape

They survived Hurricane Katrina, but can these entrepreneurs withstand a fresh whirlwind of bureaucracy?

|

| Loretta Harrison has rebuilt her praline business, which was once based in the French Market. |

|

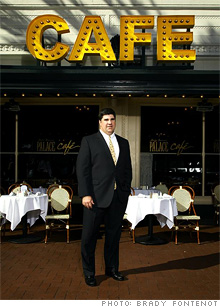

| Dickie Brennan counts on temporary-visa workers to serve diners at his Palace Cafe. |

|

| Wilbert "Chill" Wilson has doubled the revenues at his barbershop since Katrina. |

NEW ORLEANS (Fortune Small Business) -- The dunking booth is always the most popular attraction at the Broadmoor Fest, a neighborhood carnival held every year since Hurricane Katrina to celebrate the survival of one of the Crescent City's low-lying, flood-ravaged districts. At recent fairs FEMA officials were favorite targets in the booth; this year, though, everyone was waiting in line to soak a city tax assessor.

Property taxes across New Orleans are skyrocketing as a result of a citywide reassessment ordered by the Louisiana Tax Commission.

"I opened that envelope and choked on my iced tea," says Loretta Harrison, owner of Loretta's Authentic Pralines. "It was $2,700 last year. Now it's $10,000."

Meanwhile, the cost of her property insurance, like that of most entrepreneurs in New Orleans, has more than doubled since Hurricane Katrina, from $8,000 a year to $17,000. Her revenue has fallen 75% since the storm, and her workforce has shrunk from 13 to three.

Considering that nearly 8,000 small businesses in New Orleans went under from 2005 to 2007, Harrison's experience counts as a success story. She closed her stand in the open-air French Market, boosted her mail-order business, and wooed wholesale clients such as Walgreens. Like her, other entrepreneurs have adapted and persevered. But on the third anniversary of Katrina, even as another tropical storm hurls toward the Gulf region, their prosperity and survival are threatened by a new whirlwind of red tape and taxation blowing in from city hall, Baton Rouge, and Washington.

This spring, amid much debate and posturing over the nation's immigration policy, Congress voted toshrink to pre-2005 levels the number of visas available to employers for seasonal foreign workers. That means only 66,000 H-2B visas will be issued this year, down from 122,511 in 2007, when Congress allowed returning workers to come and not be counted against the 66,000 cap. Restaurants, hotels, and construction firms in particular have relied heavily on temporary foreign workers to compensate for the exodus that has left New Orleans with only 63% of its pre-Katrina population of 454,000.

"If it weren't for our H-2B employees, we'd have lines of customers out the door and empty tables inside, because we just wouldn't have enough wait staff," says Dickie Brennan, owner of the Palace Cafe and two other popular eateries. "The H-2B program has been critical to our recovery."

With tourists flocking back to the city - 7.1 million visitors in 2007, compared with 3.7 million in 2006 - Brennan requested 60 visas, up from 30 in 2006, for this coming fall and winter, which is high season for tourism in New Orleans. But it's a first-come, first-served process, so he's competing against business owners in other resort towns, such as Aspen, who are also clamoring for workers. As part of the labyrinthine application process, the U.S. Department of Labor required Brennan to run three straight days of advertisements in the Times-Picayune, guaranteeing wages of at least $10 an hour. No one applied.

One reason for the dearth of native-born employees is the scarcity of affordable housing. Louisiana's Road Home program, which was supposed to provide emergency funding to help residents rebuild their damaged homes, was so poorly managed that less than a quarter of its applicants received any money. Residents renamed the program Road to Nowhere.

In addition, out of 422,000 emergency-loan applications filed after hurricanes Katrina and Rita, only 28% were approved by the U.S. Small Business Administration. That compares with a 60% approval average after previous natural disasters, according to a 2006 U.S. Government Accountability Office report.

"Instead of nurturing struggling businesses as they adapted to the new environment following Katrina and Rita, the SBA has often strangled them with red tape and bureaucratic hurdles," says Representative Charlie Melancon (D-La.).

Government red tape ranked second only to insurance costs among the main hindrances to small-business recovery, according to "Recovery, Renewal, and Resiliency: Gulf Coast Small Businesses Two Years Later," a comprehensive study by the nonpartisan Political & Economic Research Council in Chapel Hill, N.C. The PERC study found that 26% of small-business owners still operating were bringing in less than half their pre-Katrina total revenues. And while one in four small businesses in New Orleans is ringing up more sales now than before Katrina, the report attributes most of that trend to a surge in demand for construction.

Some of the winners, however, can be found in surprising niches. Wilbert "Chill" Wilson, owner of Chill's First Class Cuts, gained local fame for operating an outdoor barbershop for 190 days straight, beginning Sept. 19, 2005. That was 21 days after Katrina struck and only one day after he returned from his evacuation to Houston.

Wilson, 40, bought a tent, some folding chairs, and a generator and set up shop, cutting hair for Red Cross workers, National Guards-men, and, gradually, returning residents. His monthly revenues doubled what he had seen before the storm.

"When I was in the tent, man, I learned to cut all kinds of hair - black people's hair, Vietnamese hair, Caucasian hair. I diversified my client base bigtime," says Wilson, who now plies his trade indoors in the more fashionable Carrollton neighborhood, where he has doubled his pre-Katrina volume.

At one point when he was still in his tent, the state threatened to fine Wilson and take away his barber's license for working in unsanitary conditions. His customers threatened protests. The state backed down. But he is facing government intervention again. His landlord just raised the rent on his 2,300-square-foot shop from $2,000 a month to $3,000 after getting hit with a fatter tax bill.

Most business owners in New Orleans acknowledge that reform of the city's property tax system - which has favored longtime property owners over newcomers and fostered corruption - is long overdue. But given the demonstrated incompetence of the city government since the 2005 storms, many wonder whether the money will go to any use other than patronage jobs and insider contracts. They also worry that the timing may bludgeon the city's recovery and question why assessments couldn't have been frozen at pre-Katrina levels for another year or two.

The tax reassessment "probably needed to happen, but they could have maybe phased it in instead of covering it in one fell swoop," says Jason Cantrell, a partner in Cantrell Law Firm who was getting a light fade in one of three barber chairs at Chill's. "People are still trying to catch up. It's a lot for them to deal with all at once, so there's a lot of frustration."

"We'd love to be able to do that, but we just can't," says Charles Ables, director of the Louisiana Tax Authority's public service sector. "The state constitution requires a property tax reassessment every four years, so we have no choice in the matter. We're bound by law."

Ables notes that in 2004, fewer than one in ten properties in New Orleans sold for within 10% of their assessed value. "We do ratio studies to make sure local assessors are in compliance, and they were not. So changes had to be made," he says.

Being forced to make changes is one concept every small-business owner in New Orleans who was around before Katrina understands all too well. "No matter how well established any of us may have been before the storm, we all had to start fresh after," says restaurateur Brennan. "It's been a fight for survival."

Between the higher taxes, escalating insurance costs, and a worker shortage that bureaucratic hassles are doing little to alleviate, Brennan says, "I don't know how we do it. We pray a lot." ![]()

Visa fight leaves businesses short summer workers

Inventor's device helps save his own flooded neighborhood

New Orleans Business Owners Update: FSB revisits five small business owners affected by Hurricane Katrina.

Rebuilding Lives: A New England entrepreneur gives Katrina victims a place to call home.

-

The Cheesecake Factory created smaller portions to survive the downturn. Play

-

A breeder of award-winning marijuana seeds is following the money and heading to the U.S. More

-

Most small businesses die within five years, but Amish businesses have a survival rate north of 90%. More

-

The 10 most popular franchise brands over the past decade -- and their failure rates. More

-

These firms are the last left in America making iconic products now in their twilight. More