Casting for profits

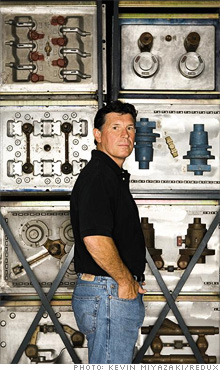

By pushing authority down into the ranks, the owner of a small cast-iron foundry reversed a pattern of red ink.

(Fortune Small Business) -- Struggling with cheap imports and cost-conscious clients, Kirsh Foundry sought a Fortune Small Business Makeover ("Lost Foundry," October 2007). The Beaver Dam, Wis., firm, which makes cast-iron parts used by various industries, had 2006 profits of about $400,000 on $12.4 million in sales.

But last year the 70-year-old firm took its first loss, of $21,000.

Jim Kirsh, 55, who owns the foundry with his brother Steve, 48, worried that his managers weren't using all the detailed data he gathered on metrics such as defect rates and labor costs. But one FSB expert saw another culprit: management. She urged Kirsh to survey senior staff to see how they viewed his leadership. A few months after the Makeover, Kirsh did just that.

"I learned I was perceived as the Wizard of Oz behind the curtain," he says. Kirsh's managers were loath to approach him. So he became more accessible and urged them to pipe up.

They did, telling him he focused on the wrong numbers: operating costs instead of profits. Kirsh reacted by giving his managers more autonomy and tying their bonuses to profits, not metrics such as scrap metal percentages. In May the staff earned bonuses for the first time in 18 months.

Sales in the first half of 2008 grew 10% over the same period in 2007. Kirsh projects 2008 sales of about $15 million (a record), with a six-figure profit.

Kirsh didn't heed all the advice offered. He won't hire a new manager to coach and oversee his staff. "It would add another layer of bureaucracy and cost $150,000 a year," he says. Nor will he alter his advisory board's makeup, opting to stick with the firm's five-member group of friends and associates.

While the costs of fuel and raw materials are up, so is demand. "My new favorite phrase is, 'Market conditions are forcing us to raise prices,' " Kirsh says. ![]()

Revving up for new business: A truck operator that hauls waste plots a better route to expand the company.

Floored by growth: An installer of carpeting and tile struggles to manage his booming business.

Help wanted for HR firm: Fortune Small Business's makeover experts visit a human-resources consulting firm seeking a smarter growth strategy.

-

The Cheesecake Factory created smaller portions to survive the downturn. Play

-

A breeder of award-winning marijuana seeds is following the money and heading to the U.S. More

-

Most small businesses die within five years, but Amish businesses have a survival rate north of 90%. More

-

The 10 most popular franchise brands over the past decade -- and their failure rates. More

-

These firms are the last left in America making iconic products now in their twilight. More