Nearly 1 million minimum-wage workers in 10 states will get a pay boost come New Year's Day.

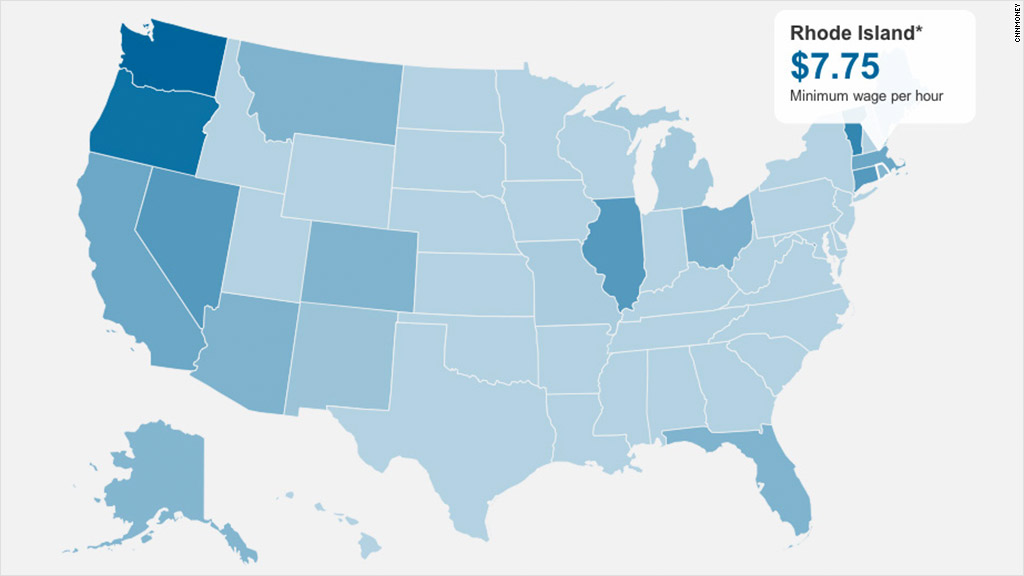

Workers in Rhode Island will see their paychecks grow the most -- by an average of $510 a year for the average worker, according to the National Employment Law Project, a nonprofit advocacy group. The state enacted a law in June raising its minimum wage 35 cents to $7.75 an hour.

In nine other states -- Arizona, Colorado, Florida, Missouri, Montana, Ohio, Oregon, Vermont and Washington -- the minimum wage will jump between 10 and 15 cents an hour, translating to an extra $190 to $410 per year on average, according to NELP. The increases in these states are the result of state "indexing" laws that require automatic annual adjustments to keep pace with rising living costs.

"If you don't do this, the lowest wage earners are going backwards," said Jen Kern, NELP's minimum wage campaign coordinator.

Related: 2013 minimum wage, state by state

An estimated 855,000 workers will be directly affected by the wage changes, while another 140,000 are projected to be indirectly affected by the changes as employers readjust their pay scales to accommodate the new minimum, according to analysis by the Economic Policy Institute.

The new hourly rates will range between $7.35 in Missouri and $9.19 in Washington state, which has the highest minimum wage in the nation.

Workers may not notice much of a change in their paychecks, though, if lawmakers do not extend the payroll tax cut first enacted in 2010. Without the tax cut in place, workers would pay 6.2% instead of 4.2% -- an amount that could wipe out most of the wage boost.

States must pay at least the same as the federal minimum wage, which has been set at $7.25 an hour since 2009 and is not indexed to inflation. That works out to an annual income of about $15,000 -- thousands of dollars below the poverty level for a family of four.

In 2013, 19 states and the District of Columbia will have rates above the federal level.

Related: What happens if the payroll tax cut expires

The increases come at a time when a growing percentage of Americans are employed in low-wage jobs. While the Great Recession saw widespread mid-wage job losses, the majority of jobs created during the economic recovery have been low-wage positions that pay $13.83 an hour or less, according to a NELP report released in August.

Some 72% of the employees set to be affected by the wage increases are adults 20 years or older, according to a NELP analysis.

"That makes it harder to dismiss the minimum wage as some marginal labor standard," Kern said. "In fact, it's a key component of economic recovery because so many of the jobs that are now characterizing our economy are impacted by minimum wage."

Wage advocates like Kern say that increasing minimum wage rates nationwide would stimulate the economy since low-income workers are more likely to spend the extra cash. Business groups counter that increases could create new job losses.