Ailing retailer J.C. Penney announced plans Thursday to raise cash through a public offering of 84 million shares.

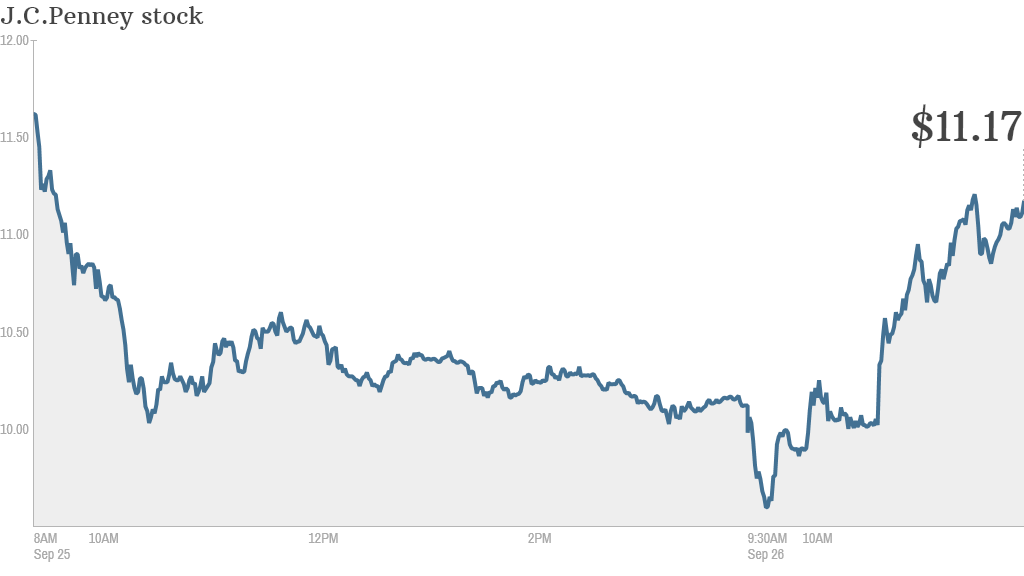

Shares continued their roller coaster ride Thursday, following a 15% plunge on Wednesday, amid reports that the firm could be seeking to raise as much as $1 billion through the sale of new stock or bonds. They closed at $10.42, up 3%, but then sank 5.3% in after-hours trading following news that the company is indeed selling shares.

J.C. Penney said it plans to use proceeds from the offering "for general corporate purposes." Underwriters will have the option to purchase an additional 12.6 million shares.

Related: Is the end near for J.C. Penney?

It's been a rough year for J.C. Penney. The company has been hemorrhaging money, losing $586 million in the second quarter alone.

Brian Sozzi, CEO at Belus Capital Advisors, said the stock was facing downward pressure Thursday due to "the shock and awe of seeing them raise more money," which could be "the last money they can raise."

Sozzi said the company's long-term survival will depend on whether the store can find a way to boost sales.

"They're going to have to really improve in 2014," he said. "If they don't, and continue to burn cash, then you really have to wonder about their survival in 2014."

Related: Ackman takes big loss on J.C. Penney

Sterne Agee analysts Charles Grom and Renato Basanata wrote in a research report that the company projects liquidity of $1.5 billion for the end of the year, but runs a significant risk of burning through it the following year.

"While we agree that liquidity will not be an issue through FY13, looking ahead to FY14 we believe that the issue of liquidity remains a big question," wrote the analysts.

Activist investor Bill Ackman added fuel to the fire when he cut his losses last month. His hedge fund, Pershing Square Capital Management, sold its entire 18% stake in the company.

Ackman had tried to save the company by recruiting Ron Johnson, former head of Apple (AAPL) retailing, to lead J.C. Penney as chief executive. But Johnson got rid of company discounts, distancing its customer base and sinking sales. So the company him pushed out earlier this year.

The company is now being led by interim CEO Mike Ullman, the former CEO of the company.

CNNMoney's Maureen Farrell and James O'Toole contributed to this report.