Investors are hoping that the strong run stocks enjoyed last month, when the S&P 500 gained 5%, continues into November.

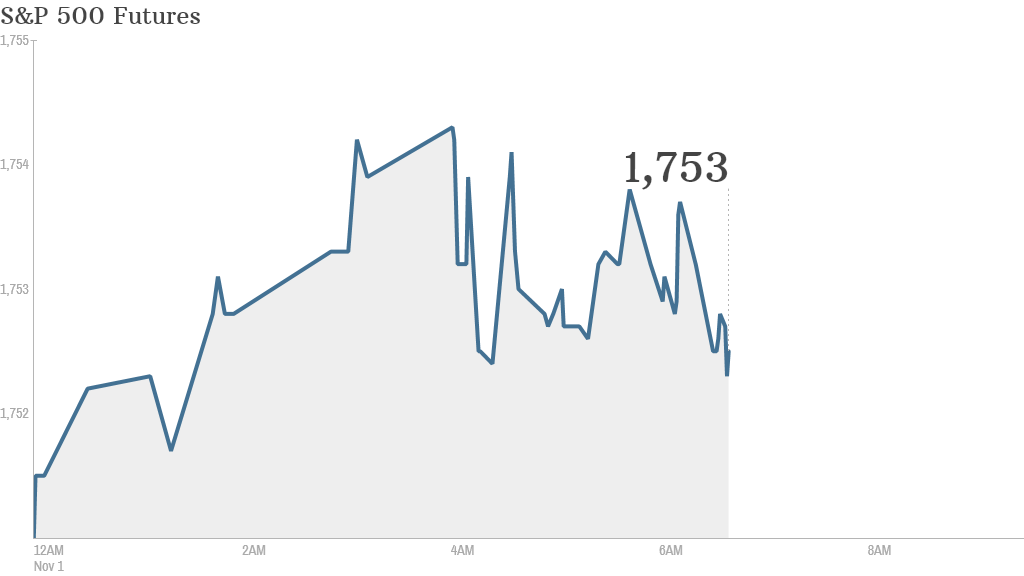

U.S. stock futures edged slightly higher, while stocks in Europe dipped in early trading.

The main economic report coming out Friday is the ISM Index for October, which will be released at 10 a.m. ET.

Chevron (CVX) is due to report its quarterly results before the opening bell.

Various major automakers will release their October sales figures through the course of the day.

Related: Fear & Greed Index, still greedy

On the other side of the world, Sony (SNE) shares fell by more than 11% Friday after the Japanese electronics maker posted a loss for the second quarter and said profits for the year would be 40% lower than forecast.

Shares in the Royal Bank of Scotland (RBS) slid around 4% in London after the U.K. bank reported far worse than expected quarterly figures.

Related: China's Craigslist soars in IPO

Avon (AVP) shares were declining in premarket trading, extending Thursday's 22% plunge. The U.S. cosmetics giant has been trying to stage a turnaround but posted much weaker-than-expected quarterly results on Thursday.

On the upside, First Solar (FSLR) stock surged in premarket trading after the firm reported quarterly earnings beat expectations.

Overall, U.S. stocks fell Thursday.

European markets were in the red in morning trading.

Asian markets ended with mixed results. The major indexes in China got a boost as a new report showed factory activity in the country picked up speed in October. Japan's Nikkei lost 1%.