When it comes to your personal finances, 2014 may be your best chance to take advantage of low interest rates and get out of debt -- before it really starts costing you.

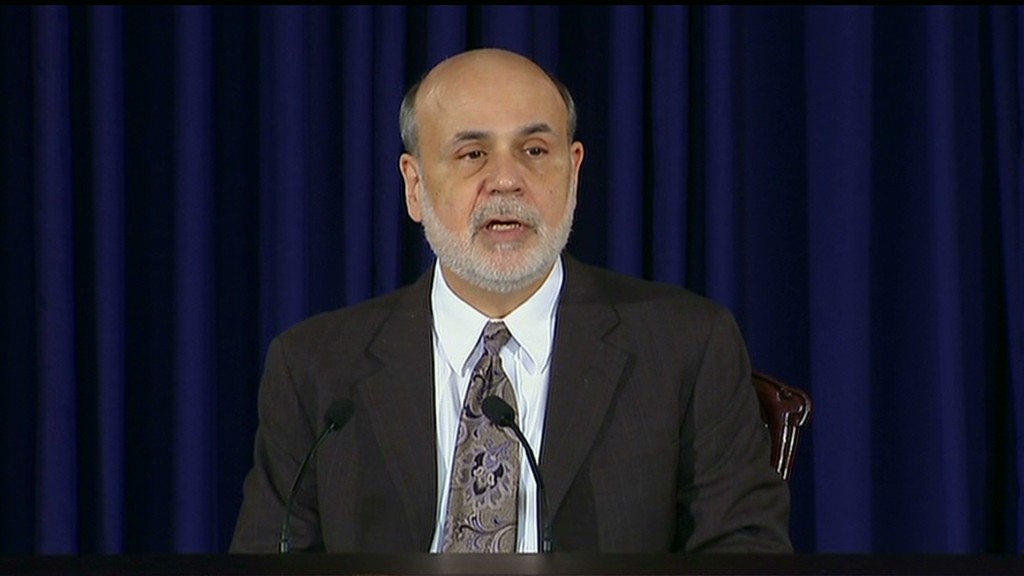

Since the 2008 financial crisis, the Fed has made monthly bond purchases in order to keep rates extraordinarily low and encourage consumer spending and borrowing. With the economy on the mend, the Fed is now slowly pulling back on those purchases, or tapering.

Long-term interest rates have already risen in anticipation of the Fed's decision, so there likely won't be a rapid spike in mortgage rates, which are already more than a percentage point higher than last year's historic lows. Still, prospective borrowers could see mortgage rates reach more than 5% this year as the economy continues to strengthen, said Keith Gumbinger, vice president at mortgage information site HSH.com.

But many other consumer loans should remain cheap since they are tied to short-term interest rates, which the Fed has committed to keeping near zero.

Related: 4 money resolutions to make now

The so-called prime rate, the rate at which banks lend to their best customers, has stayed at 3.25% since 2008 and isn't expected to move higher in 2014. As a result, borrowers will continue to enjoy lower rates on student loans, car loans and credit cards, among other short-term loans.

But that won't always be the case, and that makes now a good time to tackle those credit card bills, said Greg McBride, senior financial analyst at Bankrate.com.

"The message I would give to borrowers is 2014 could be your last hurrah," he said. "The days are numbered. It makes sense to plan accordingly and really start to hammer away."

Currently, credit cards are charging an average annual percentage rate of around 15%. While borrowers with poor credit can face higher double-digit rates, the most creditworthy consumers will continue to see APRs in the single digits, and will receive 0% introductory offers for as long as 18 months, said McBride.

Even the difference of a few percentage points can make a big difference.

Let's say you resolve to pay off $5,000 worth of credit card debt in a year. A card with a 10% interest rate would ultimately result in $275 in interest payments on top of the $5,000. If the interest rate were to jump to 15%, the same payoff would require $416 in interest, an increase of more than 50%.

Related: 10 things you'll pay more for in 2014

Car loans are also expected to stay near record lows this year, with 3% to 4% offers remaining fairly common, McBride said.

Similar to car loans, many private student loan borrowers will continue to enjoy low single-digit rates. But that doesn't mean they will stay there. Private student loans are typically tied to the prime rate or the rate at which banks lend to other banks, called Libor.

That makes it a good time to pay down that student loan bill, since these loans typically carry variable rates that will jump when rates rise in coming years.

But there's also a downside to low interest rates. It will be yet another frustrating year for savers. Savings accounts, money market accounts and short-term certificates of deposit will continue to have average returns far below 1%. A typical savings account with deposits of $1,000, for example, will earn less than $1 in annual interest.

Five-year CDs, which currently have average returns of around 0.8%, may offer slightly higher rates later this year but returns will remain paltry.

"The bottom line is [rates] could double, and it still wouldn't be enough to get you off the couch," he said.