They say all that glitters...you know the rest.

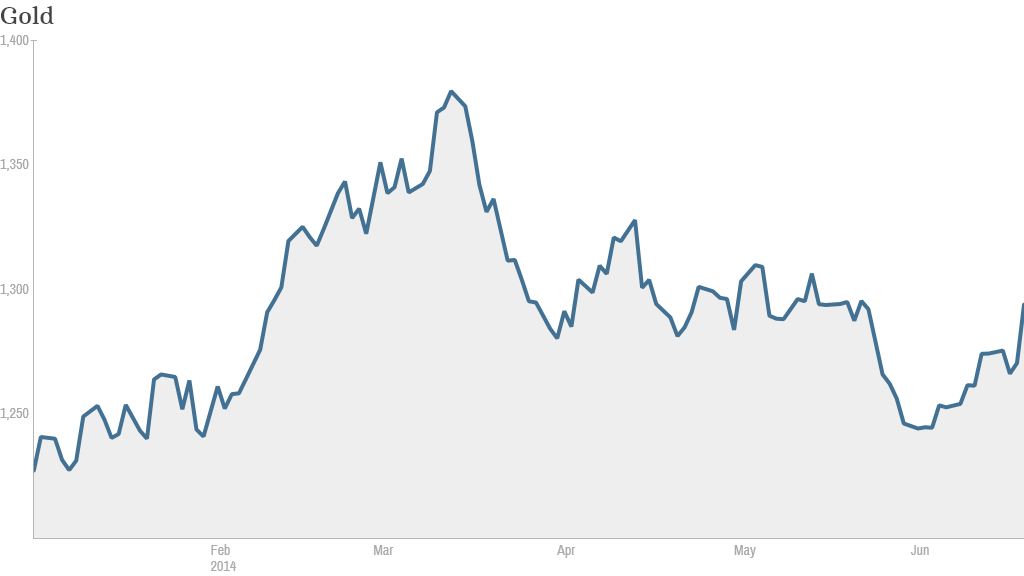

Gold prices shot up more than 3% on Thursday, the biggest one day gain since September 2013. Prices were up slightly again Friday, with futures trading at about $1,316 an ounce.

So far this month, gold prices have risen nearly 6%.

While gold bugs have regained some swagger, analysts don't expect the metal to break out of the funk it's been in for the past year.

The recent jump in gold prices comes as turmoil in Iraq has put some investors on edge. Gold and other so-called "hard" assets often find favor in times of political and economic uncertainty.

Meanwhile, Russian forces have been massing on the eastern border with Ukraine, raising concerns about an escalation of tensions in an already volatile region.

"There are a lot of reasons investors should own gold," said Donald Doyle, chief executive of Blanchard & Co., a precious metals dealer in New Orleans. The current geopolitical uncertainty "illustrates the metal's qualities as insurance when governments clash."

Doyle added that investors were also spooked by comments from Federal Reserve chair Janet Yellen on Wednesday. Yellen reiterated that the central bank is unlikely to hike interest rates any time soon.

Some investors see gold as an alternative to the U.S. dollar, which they believe is being undermined by the Fed's policies.

Related: Water becoming more valuable than gold

But other analysts say Thursday's rally was driven by technical factors, such as "short covering."

The price of gold rose above its 50-day moving average early Thursday, which triggered a wave of buy orders and caused investors who were betting against the metal to unwind their positions, said Carlos Sanchez, a precious metals analyst at the CPM Group.

Investors have been "short" gold for at least a year, meaning they are positioned to benefit from falling prices. Analysts say that's not likely to change anytime soon.

The summer months are historically very slow in the gold market. In addition, demand from China, which has been a big consumer of physical gold, is slowing down.

While geopolitical concerns could help support the metal in the short term, "I still think gold is headed lower," said Sanchez.

That's largely because the stock market continues to hit record highs.

And despite worries about Ukraine and Iraq, investors don't appear to be that scared. The VIX (VIXAUG), a key measure of volatility, is at its lowest point since 2007. And the CNNMoney Fear & Greed Index, which looks at the VIX and six other measures of investor sentiment, is showing signs of Extreme Greed.

Investors fled the gold market last year as they chased better returns in more risky assets. Gold prices fell nearly 30% in 2013. It was the biggest decline since 1981 and the first year-over-year drop since 2000.

Gold hit an all-time high near $1,900 an ounce in 2011, as investors worried about a global economic collapse. But the metal has fallen out of favor with stocks in the midst of a five year-old bull market.

Related: Funds dumped $40 billion in gold last year

"The fact that the equity market continues to be strong doesn't give traders much incentive to get into gold," said Rob Kurzatkowski, senior commodities analyst at optionsXpress.

Gold will probably continue to trade in the range it has been in for most of the year, between $1,200 and $1,300 an ounce, Kurzatkowski added.

"Gold may just continue to grind here," he said. "There are too many factors underpinning the market for gold to collapse, but there's not enough to spark the metal higher either."