The Federal Reserve has run out of patience. And Wall Street couldn't be happier.

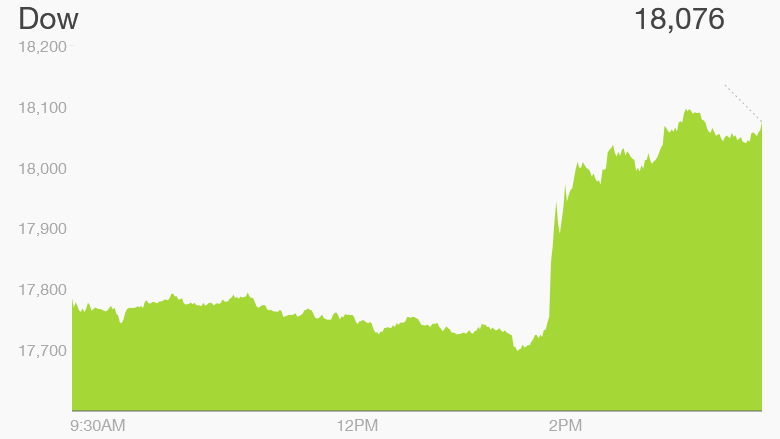

Stocks surged after the Fed's latest statement was released Wednesday afternoon. The Dow was deep in loss territory and then jumped over 300 points in a matter of minutes. The index ended the day up 227 points and back above 18,000.

The S&P 500 and Nasdaq quickly popped as well. The Nasdaq even briefly surpassed 5,000 again and is not far from its all-time high from March 2000. Here's why.

The Fed didn't do anything unexpected. The market hates surprises.

Related: Prepare for a rate hike. Fed removes 'patient'

Investors were well prepared for the Fed to drop the word "patient" -- which it had been using to describe the timing of an eventual rate hike -- from its statement.

What it means: But the central bank reassured the market that a rate increase was "unlikely" at its next meeting in April. That is not a surprise either. Wall Street has been betting on rates starting to go up in June or later.

The Fed also issued new forecasts. It lowered its 2015 and 2016 outlook for gross domestic product (GDP) slightly. It also cut its inflation forecasts and predicted that the unemployment rate will fall further than it thought a few months ago.

According to the Fed's so-called dot plot -- which shows where each Fed member thinks rates should be -- the median estimate for interest rates is 0.625% at the end of 2015. In December, the median was 1.125%

All this suggests the Fed will take a slow and steady approach to rate hikes. That should calm down investors who had been worrying the Fed would boost rates too quickly.

"The Fed and market had been in sync on the timing of a rate hike but not the pace and amount of them," said Michael Arone, an investment strategist with State Street Global Advisors. "The Fed has now made it clear that removing the word 'patient' does not mean it will be impatient."

Related: Why I'm still bullish on stocks

The problems ahead: Yellen is keeping an eye on the dollar and wage growth. The stock market has been volatile lately because the dollar has strengthened against other currencies due to economic weakness in Europe and Japan. That's led to fears that profits for big U.S. companies could be hurt.

During her press conference, Yellen stressed that she is also paying close attention to what was going on international markets.

"The Fed wants maximum flexibility. They want to be able to react to not just what's going in the United States, but also what's happening with the global economy, the dollar and oil prices," said David O'Malley, CEO of Penn Mutual Asset Management.

Yellen admitted that the dollar's surge could be a negative for U.S. companies since it has led to lower prices for imported goods. But she added that "the strength of the dollar in part reflects the strength in the U.S. economy."

Related: This is the U.S. dollar's fastest rise in 40 years

Jobs, jobs, jobs: Yellen also said that the health of the job market is key. The unemployment rate has fallen to a 7-year low, but wages have yet to increase much, if at all when you take into account inflation.

Yellen conceded wages have not picked up, but said wage growth isn't necessarily a "precondition" for rate hikes. In other words, the Fed could still raise rates this summer even if wage growth is sluggish.

Bubble 2.0? Yellen was also asked if she was worried about market bubbles.

Stocks have rallied for more than six years. The Fed indicated last year that there may be bubbles in certain sectors of the economy, including social media and biotech.

Yellen reiterated that stock market valuations are "on the high side" but they are still within historical ranges.

Bonds could be another bubble though. Investors plowed back into U.S. Treasury debt Wednesday despite the Fed's intention to raise rates. The yield on the 10-Year Treasury fell back below 2%. Bond yields go down when investors are buying bonds.

The U.S. dollar also had its biggest drop in six years, although the dollar remains strong relative to other currencies.