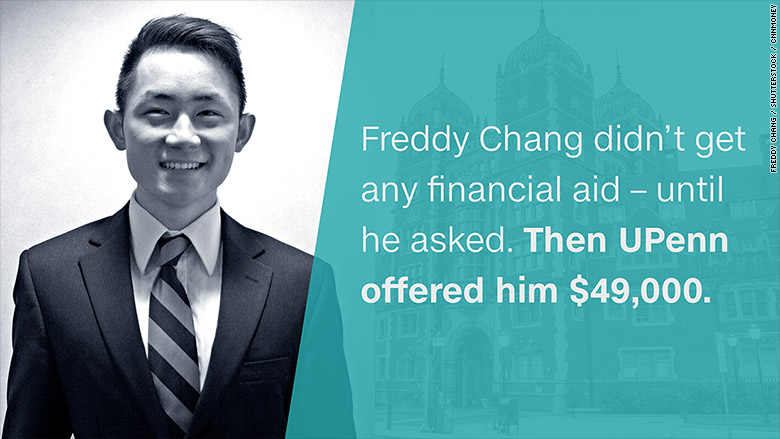

Freddy Chang was ecstatic when he was accepted early to the University of Pennsylvania. But then he took a look at the financial aid package, and his heart sank.

His dream school wasn't offering him any money and his family would be on the hook for about $64,000 in just the first year.

"I was so upset. I knew my parents wouldn't be able to afford the whole price tag," Chang said.

But then he wrote an appeal letter, asking the college for some financial help -- something that a lot of students and parents don't realize they can do.

It worked. The college came around and offered him two scholarships and one grant worth about $49,000 total. Chang is now finishing up his freshman year.

Not everyone who appeals gets more money, but it does work for some. Experts agree it's worth a shot.

"We've had a lot of clients who ended up getting more money by doing this," said Eric Greenberg, whose team at Greenberg Educational Group has been advising students on getting into and paying for college since 1991.

Related: How to read your ridiculously confusing financial aid letter

There's no guarantee that an appeal letter will get you more financial aid since Colleges have a reason to make their original offer a fair one.

"They don't want to low-ball students so that they immediately jump to a different school," Greenberg said.

Startup NextGenVest helps college-bound students write appeal letters at no cost. That's where Chang turned for help.

In his letter, Chang explained how his parents immigrated from Myanmar and he's the first in his family to go to college. He explained why he's such a good fit for the school's dual degree program in international studies and business. And he hinted at the fact that he had been offered better aid packages at other schools.

NextGenVest founder Kelly Peeler suggests including another teacher recommendation with the appeal letter, and following up with a phone call.

Chang did just that. He eventually got a call back and was told an adjustment had been made to his financial aid award. That was all it took.

But not everyone has the same bargaining chips as Chang.

Three experts told CNNMoney what factors could work in your favor:

Can you do a better job explaining your financial situation?

"There are a lot of situations that don't fit into the FAFSA boxes," said Alicia Stewart, an admissions counselor at IvyWise.

Maybe your parents are close to retirement age. Maybe they're taking care of their own elderly parents. Perhaps an older sibling has moved back home after college and still depending on your parents financially. These are all things you can bring to the college's attention, Greenberg said.

Have your family's finances changed?

If your family's financial circumstances have changed in the past year, you definitely need to bring that up. Maybe a parent has fallen ill, or lost their job. That dramatically changes your family's ability to pay for college.

"Putting that into a formal letter, with more context, could encourage a college to give you more money," said Peeler.

Did you get into a comparable college?

Colleges can be extremely competitive. They're very concerned with attracting as many applicants as possible, keeping acceptance rates low, and getting as many of those as they can to graduate, said Greenberg.

If you were accepted at a comparable school and it's going to cost you less to go there, all three experts suggest including that in your appeal letter.

Do you have a contact at the school?

Stewart recommends leveraging connections you may have already made when visiting the college -- whether that's someone in the admissions office, a professor, or a coach.

Related: How he won 35 scholarships and went to college for free

Even if this is something you can do over the phone or email, Greenberg suggests trying to go in person. Take advantage of any upcoming events for accepted students to meet with someone in the financial aid office.

Whatever your approach, do it now. Colleges don't have a bottomless pot of scholarship money to award, and many require you to enroll by the first week in May.

Were you able to pay for college without taking out loans? Share your story with CNNMoney by emailing Katie.Lobosco@cnn.com.