In contrasting her economic vision with Donald Trump's on Thursday, Hillary Clinton slammed what she termed the "Trump Loophole."

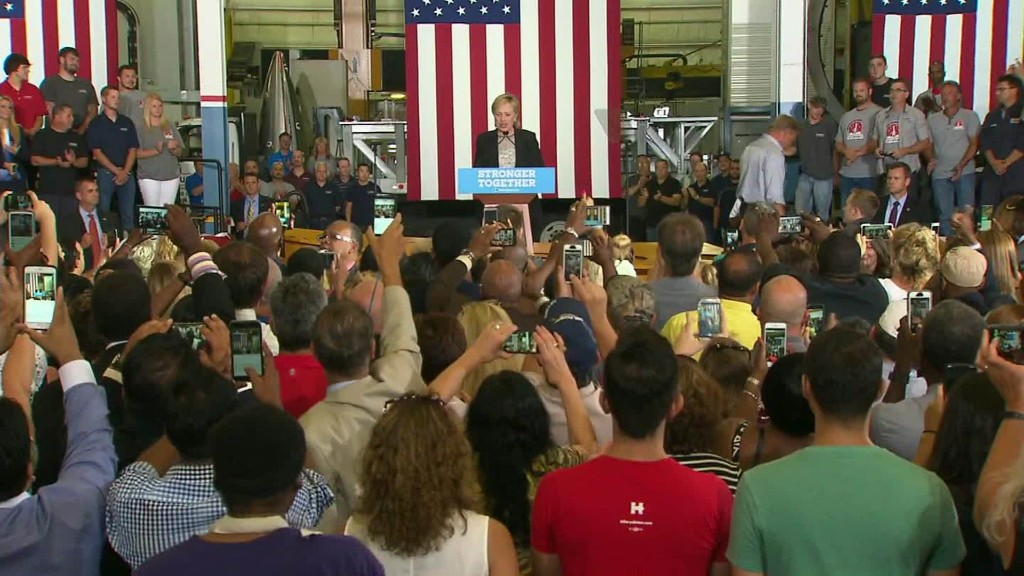

"It would allow him to pay less than half the current tax rate on income from many of his companies. He'd pay a lower rate than millions of middle class families," Clinton said during her speech in Warren, Michigan.

Here's what she is referring to: Under his tax reform proposal Trump would slash the income tax rate on all business income to 15%. That includes business entities such as limited partnerships (LPs), limited liability corporations (LLCs) and S Corps.

They're known as pass-throughs entities, because the entity itself isn't subject to income tax. Instead, its profits are passed along to its shareholders and partners, who then report them on their individual tax returns.

Today, those profits are taxed at a top rate of 39.6%. Under Trump's proposal, they would be taxed at just 15%.

Trump's financial disclosure documents -- which list all of his assets and businesses interests -- are chock-full of LLCs and LPs.

Related: Here's how much Hillary Clinton's tax plan would hit the rich

The same 15% rate would also apply to profits at sole proprietorships and mom-and-pop shops.

Trump says having a much lower business tax rate is "geared towards keeping jobs and wealth inside the United States."

Anyone who makes their living from a paycheck, however, would face much higher rates. Under Trump's plan wages and salaries would be taxed at 12%, 25% and 33%.

Tax experts worry that having such a huge disparity between the top rates for wage income (33%) and business income (15%) will cause a lot of people to recharacterize as much of their income as possible as business income.

Get the right tax professional and "it would be child's play," said Steve Rosenthal, a tax lawyer and senior fellow at the Tax Policy Center. "You can wrap a partnership around almost any activity."

Doing so would be particularly beneficial for very high-income professionals because their top rate would drop by more than half.

"Why should all the lawyers, accountants and doctors who run their income through partnerships be subject to a 15% rate because it's considered business income, when if they just worked for a living it would be taxed at 33%?" Rosenthal said.