With just a month to go before the election, Hillary Clinton detailed a new proposal to help limit the burden of child care costs for lower and middle income families.

She wants to double the child tax credit for children under 5 years old.

A credit is a dollar-for-dollar reduction of the taxes you owe.

Today low- to upper-middle-income parents may claim up to $1,000 per child under the age of 17. Under Clinton's plan they could claim up to $2,000 for any children who are infants, toddlers or preschoolers, or $1,000 for those 5 and older.

In addition, Clinton would expand how much of the credit is refundable. That is, when the credit exceeds parents' taxable income, they can get at least part of it back as a refund. Currently, they can get back 15% of their earnings over $3,000, up to the credit's full $1,000-per-child value.

Clinton would expand that to 45% when the credit is taken for a child under age 5.

Related: How paid family leave could become a reality in the U.S.

In addition, she would eliminate the $3,000 minimum income requirement for all parents of children under 17. So those who qualify for the refundable portion of the credit could apply the 15% (or 45% for young kids) to all of their earnings.

The idea is to provide very low-income families with a better benefit. Under the current structure, they typically do not receive the full credit, even though they need the most help.

The credit currently phases out for higher income families, and the same would be true under Clinton's plan, although the campaign didn't specify the income level.

Today it starts when parents with two kids earn more than $110,000 ($75,000 if single or head of household), according to the Center on Budget and Policy Priorities. Once their income hits $150,000 ($115,000 if single or head of household) they would no longer be eligible to claim the credit.

Related: What Donald Trump and Hillary Clinton want to do to your tax bill

The Tax Policy Center estimates Clinton's child tax credit expansion would reduce revenue by $209 billion over 10 years.

Part of a broader plan

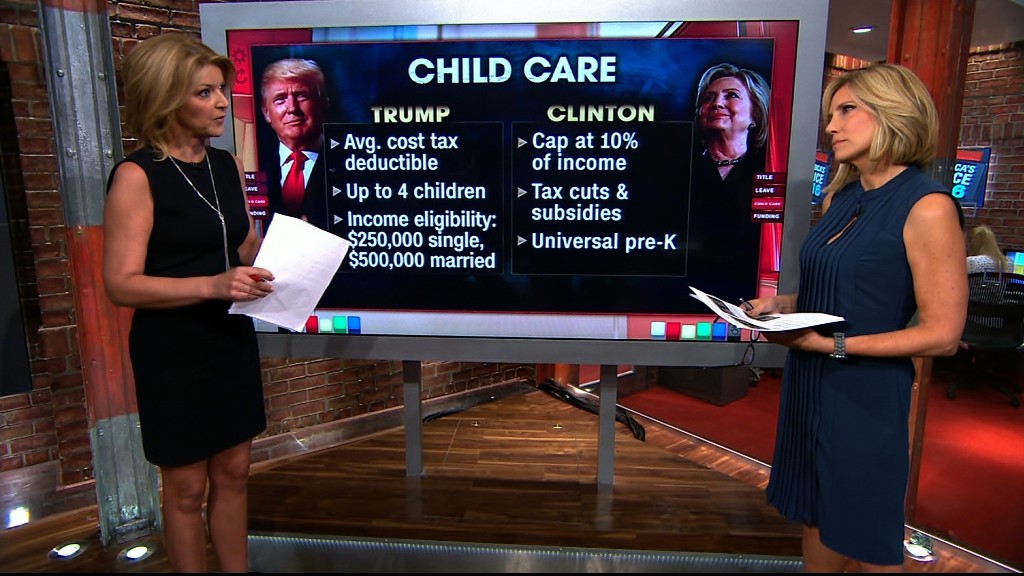

Previously, Clinton has called for capping the cost of child care at no more than 10% of a family's income. Her child tax credit expansion would contribute toward that goal.

Over the next decade she also wants to provide universal pre-K for all 4-year-olds.

And she wants to guarantee that parents can take off up to 12 weeks paid at a minimum of two-thirds of a worker's current wages up to a cap.

As with virtually all her proposals to help the middle class and low-income families, Clinton vows to pay for them by making sure "the wealthy, Wall Street and big corporations pay their fair share."

Her opponent, Donald Trump, has also put forth a few proposals to make child care more affordable for families. They include allowing parents to deduct the average cost of child care in their state, creating a tax-advantaged dependent care savings account and allowing women whose employers don't offer paid maternity leave to collect six weeks of unemployment benefits when they have a child.