1. Markets mull next move: The Dow Jones industrial average hit a record high on Monday and it could push on further today.

Investors have shrugged off a series of big political shocks in the last few weeks, and many global stock markets are in bull market territory -- up 20% or more from lows set earlier in 2016.

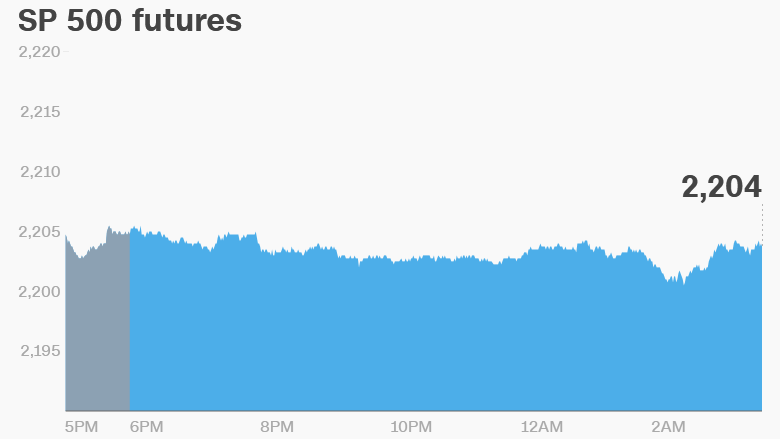

U.S. stock futures are holding steady ahead of the opening bell.

European markets are mainly higher in early trading, though the moves are small. Asian markets ended the day with decent gains.

2. Bracing for a bank bailout: Concerns persist about the ability of Italy's oldest bank to follow through on a turnaround plan and avoid a state bailout.

Shares in Banca Monte dei Paschi di Siena (BMDPF) dropped 3% Tuesday. The stock has crashed more than 85% since the start of the year.

Monte dei Paschi is trying to arrange a €5 billion ($5.4 billion) capital infusion, but political uncertainty triggered by the resignation of Italian Prime Minister Matteo Renzi has made securing the funds more tricky. Investors are worried that a period of instability could inflict further pain on Italy's struggling economy.

Shares in other major European banks are mostly rising.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

3. Earnings: Auto parts retailer AutoZone (AZO) is releasing its earnings before the open Tuesday.

AutoZone is expected to log its 41st straight quarter of double-digit growth in earnings per share. The company is benefiting from Americans' need to repair their aging cars as well as the company's aggressive share buybacks.

Then after the close, Dave & Busters (PLAY) plans to release its earnings.

4. Economics: New numbers due Tuesday highlight two areas of focus for the new Trump administration: trade and manufacturing.

First, the Census Bureau is reporting October data on the U.S. trade deficit at 8:30 a.m. ET. Then the Census Bureau will report details on new orders for manufactured goods in October at 10 a.m.

Download CNN MoneyStream for up-to-the-minute market data and news

5. Coming this week:

Wednesday - Senate hearing on AT&T-Time Warner merger; GSA weighs in on Trump's hotel lease; Starbucks Investor Day; India's rate decision

Thursday - European Central Bank's monetary policy meeting

Friday - Government spending measure expires