Two years ago, President Obama proposed a new program to help Americans save for retirement.

He wanted to help low- and middle- income Americans who don't get a pension or 401(k) from their employers. About half of U.S. workers don't have either.

"Today, most workers don't have a pension. A Social Security check often isn't enough on its own. And while the stock market has doubled over the last five years, that doesn't help folks who don't have 401(k)s," Obama said during his 2014 State of the Union address.

Now those workers have the option of opening a "myRA" -- a starter retirement account that's similar to a Roth IRA but sponsored by the federal government.

In addition to the federal program, a handful of states are working to offer their own retirement savings plans, the first of which will launch in 2017.

"There's a growing realization that too many people don't have the opportunity to save for retirement, and we're finally starting to see something done about this," said David John, an adviser at the AARP Public Policy Institute.

myRA enrollment on the rise

Obama's myRA became available nationwide last November and enrollment has been growing steadily.

But only about 20,000 people have signed up for a myRA to date, the Treasury Department told CNNMoney this week.

It's a paltry number when compared to the roughly 55 million workers who don't have access to an employer-sponsored retirement plan.

But some retirement experts predict the number of enrollees will start rising fast.

"I think Treasury was taking a very careful, measured approached to make sure everything works -- but the future of myRA is very bright," said John.

He expects awareness of the program to grow, bolstered by new state programs that promote myRA. The Treasury Department said it will do more next year to highlight myRA on government websites, as well as promote it through TurboTax.

Limits of the myRA

So far, the program is working as planned.

"Most of the participants are using myRA as we expected, with small monthly contributions," said Richard Ludlow, the myRA Executive Director at Treasury.

Those monthly contributions average between $50 and $100. And participants are fairly evenly distributed among age and geography.

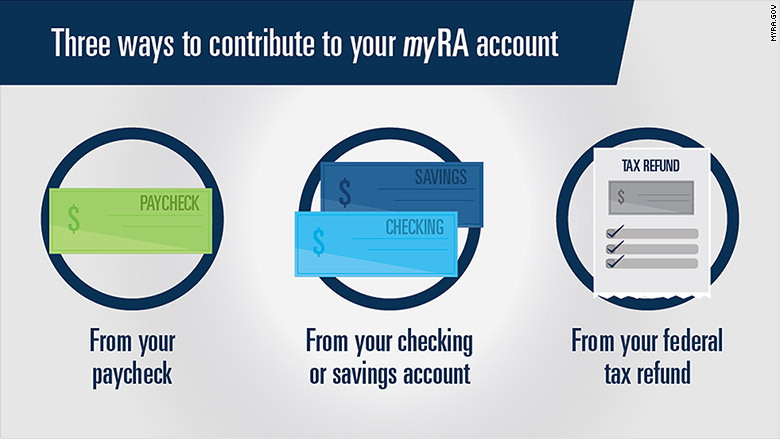

Most people link their checking or savings account to the myRA, but participants can also choose to transfer after-tax dollars from their paycheck or direct some of their federal tax refund to the account. You're eligible as long as you make less than $131,000 a year (or $193,000 for married couples).

The myRA is 100% risk-free and doesn't have any administrative costs.

But here's the catch: don't expect your money to grow too much. Your funds are invested in a super-safe Treasury Securities Fund that offered a return of 2.9% over the past decade. That might be better than a typical savings account, but less than what some riskier investments might make.

"It's a good place for short term savings, but it's a very bad device for retirement," said Teresa Ghilarducci, a labor economist and expert in retirement security.

She points to two reasons why: It doesn't invest your funds in a diversified portfolio, and it allows you to pull out the money you contributed (not the interest) at any time without penalty.

It's also capped at $15,000 total and you cannot have it open for longer than 30 years. At that point -- or sooner if you choose -- you have to rollover your money to a private Roth IRA.

A reason to be optimistic

The average American under age 40 says there's only a 50% chance they could come up with $2,000 next month for an emergency. The myRA is a solid place to get that rainy day fund started. And it's difficult to save for retirement if you don't have at least enough in cash to cover an emergency.

"It's a very good program for someone just starting out, but it's nothing more than that," John said.

But it could be a good companion to some of the savings accounts expected to roll out in states like California, Connecticut, Illinois, Maryland, and Oregon.

All five states have passed laws that will require employers without a plan to automatically enroll their workers in state-sponsored IRAs, according to the Center for Retirement Research at Boston College.

The key difference here is that workers would be automatically enrolled. While they would have the choice to opt out, research suggests more people would remain enrolled.

Despite some initial resistance from small business owners and some financial service firms, legislation for these plans have largely passed with bipartisan support.

Details are still being worked out about what kind of investments would be offered. In California, where the program is expected to begin in mid-2017, funds will be invested in U.S. Treasuries, or similar low-risk investments -- at least at first -- and may eventually offer other investment options.

"It's very encouraging to finally see something being done about this. Because the worst case scenario going forward is that 55 million people will enter retirement with nothing other than Social Security and a few other resources," John said.