1. Inauguration Day: On Friday, Donald Trump will be sworn in as the 45th president of the United States.

Since his election, Trump has shown an uncanny ability to move markets. Bullish investors, girded by his pro-business rhetoric, have pushed the Dow closer and closer to 20,000 points. But the Republican has also introduced a degree of uncertainty. Trump has made a habit of targeting specific companies on Twitter with little notice. His marks, such as Boeing (BA) and Lockheed Martin (LMT), have seen shares plummet as a result.

Corporate America could be in for a bumpy ride over the next four years.

Related: Lee Greenwood to perform at concert for Donald Trump's inauguration

2. Time for Davos: Business and political leaders from around the world will convene in Davos, Switzerland on Tuesday to kick off the World Economic Forum.

IMF director Christine Lagarde, Facebook (FB) COO Sheryl Sandberg, U.K. Prime Minister Theresa May, Chinese President Xi Jinping and Alibaba (BABA) founder Jack Ma will be among those in attendance. This year's theme is "Responsive and Responsible Leadership."

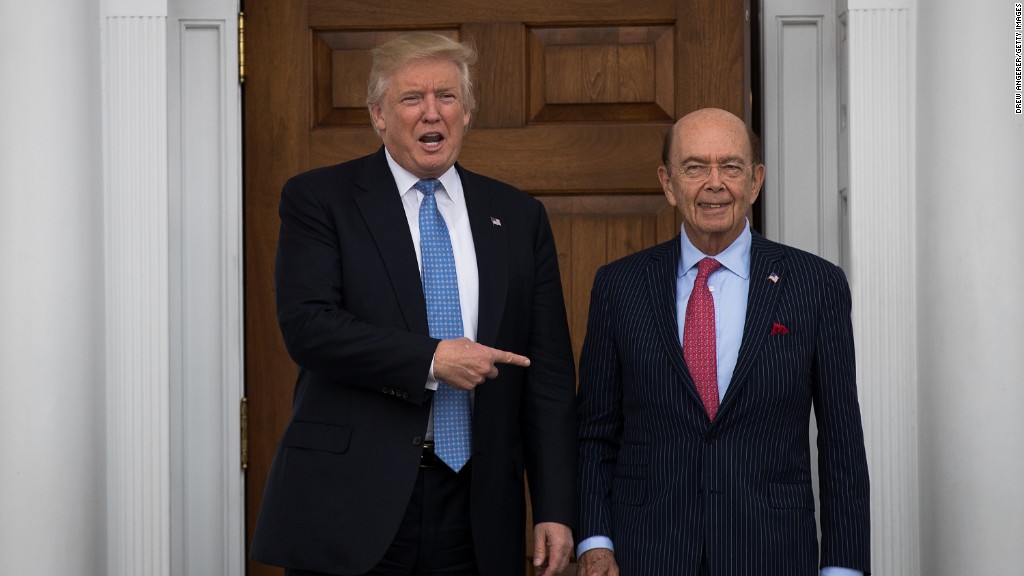

3. Wilbur Ross confirmation: The Senate will decide whether to confirm billionaire investor Wilbur Ross for Commerce secretary on Wednesday.

Ross is known for buying up distressed and failing companies. He made a name for himself acquiring troubled assets in the steel and coal industry, but has focused more on banks since the 2008 financial crisis.

The Senate's hearing for Tom Price, Trump's pick to lead the Health and Human Services department, is also on Wednesday. Price, an orthopedic surgeon, is an ardent critic of Obama's Affordable Care Act.

Related: Trump taps 'King of Bankruptcy' as Commerce Secretary

Related: How Trump's health secretary pick would replace Obamacare

4. A smattering of earnings: Goldman Sachs (GS), Netflix (NFLX) and American Express (AXP) are among companies reporting earnings this week.

Investors will watch Goldman Sachs, Morgan Stanley (MS) and Citi (C) to see if they match last week's solid reports by JPMorgan Chase (JPM) and Bank of America (BAC). Bank stocks have been on a tear since the election, boosted by the expectation of fewer regulations and rising interest rates when Trump becomes president.

Netflix is also likely to garner significant attention when it posts earnings Wednesday. Last quarter, the Wall Street darling announced it had added 3.6 million subscribers, shattering expectations. The company's stock gained 8% in 2016 and hit an all-time high at the beginning of January.

Related: Jamie Dimon is hopeful about Donald Trump

Related: Netflix at all-time high? Stranger things have happened

5. Coming this week:

Monday - Markets closed for MLK day

Tuesday - Davos begins; Morgan Stanley earnings

Wednesday - Wilbur Ross and Tom Price confirmation; Citi, Goldman Sachs, Netflix earnings

Thursday - ECB interest rate announcement; IBM (IBM) and American Express earnings

Friday - Inauguration Day