1. Let's make a deal: Investors are reacting to two major deals.

The first involves Broadcom, which has announced plans to acquire CA Technologies (CA) for $18.9 billion in cash.

Broadcom makes computer chips and CA Technologies builds software for information technology management. The boards of both companies have approved the deal.

CA stock was up 16% in extended trade. Shares in Broadcom (AVGO), which saw its attempted takeover of Qualcomm (QCOM) blocked earlier this year by the Trump administration, slipped 6%.

Investors also have the chance to catch up on the latest developments in the battle over European broadcaster Sky, which pits 21st Century Fox (FOX) against Comcast (CMCSA).

Comcast announced a new bid late Wednesday that values Sky at £26 billion ($34 billion).

The offer came hours after 21st Century Fox said it had a reached a deal to buy Sky that valued it at £24.5 billion ($32.5 billion). Fox already owns 39% of Sky.

Sky is seen as a valuable asset for US media companies that are looking to expand into Europe. Sky shares, which have gained 52% this year, jumped 2% higher in London.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

2. Papa John steps down: John Schnatter, the founder and public face of Papa John's, has resigned as the company's chairman after it emerged he used the N-word on a conference call in May.

Papa John's (PZZA) said in a statement late Wednesday it would appoint a new chairman "in the coming weeks."

Shares in the company were steady ahead of the open, following a 4.8% drop on Wednesday.

Schnatter apologized after Forbes reported that he used the racial slur while participating in a role-playing exercise designed to prevent public relations crises.

In a statement issued through the company, Schnatter said: "News reports attributing the use of inappropriate and hurtful language to me during a media training session regarding race are true. Regardless of the context, I apologize. Simply stated, racism has no place in our society."

3. Asia market movers -- SoftBank, ZTE: Shares in Japanese tech conglomerate SoftBank (SFTBY) jumped more than 6% in Tokyo based on reports that New York hedge fund Tiger Global Management had taken a stake of more than $1 billion in the company, saying its price is "significantly undervalued."

"We continue to believe the market significantly undervalues our stock and we welcome the support from a sophisticated institutional investor like Tiger Global," a SoftBank spokesman told CNNMoney. Tiger Global wasn't immediately available for comment outside regular office hours.

ZTE shares spiked 25% in Hong Kong after the US government announced the Chinese company will soon clear the last major hurdle to removing a crippling ban.

ZTE (ZTCOF), which makes smartphones and telecommunications equipment, has been in crisis mode since the US Commerce Department blocked American companies from selling it vital components in April.

The Trump administration reached a deal with ZTE to lift the ban in exchange for a series of other punishments, including the company overhauling its top management, bringing in an American monitoring team and paying a $1 billion fine.

4. Brexit update: The British government will publish a blueprint on Thursday that details its strategy for Brexit.

The plan is unlikely to be accepted by the European Union in its current form.

"How quickly the European Union rejects the terms may hint at the probability of a hard or soft exit," said Paul Donovan, global chief economist at UBS Wealth Management.

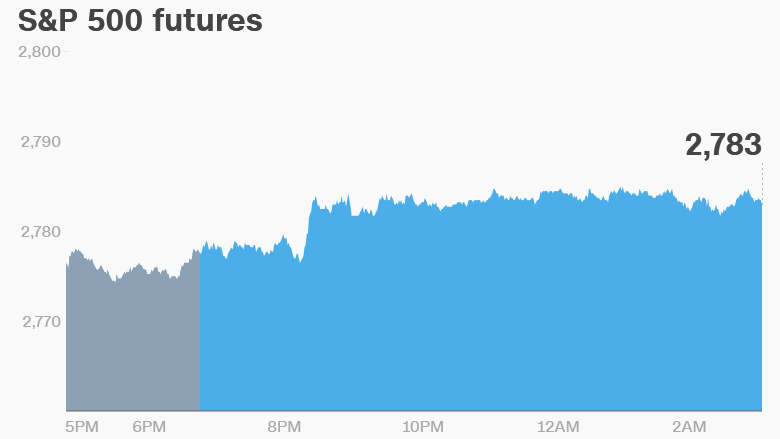

5. Stock market overview: US stock futures were pointing up.

Major European markets advanced in early trading. Asian markets ended the day with gains. The Shanghai Composite rallied 2.2%.

Markets Now newsletter: Get a global markets snapshot in your inbox every afternoon. Sign up now!

6. Coming this week:

Thursday — Delta Air Lines (DAL) earnings; US Bureau of Labor Statistics releases June inflation data

Friday — Citigroup, JPMorgan Chase, Wells Fargo, First Republic Bank (FRC) report earnings; Consumer sentiment index released