Tensie Whelan is founding director of NYU Stern's Center for Sustainable Business and clinical professor of Business & Society. The opinions expressed in this commentary are her own.

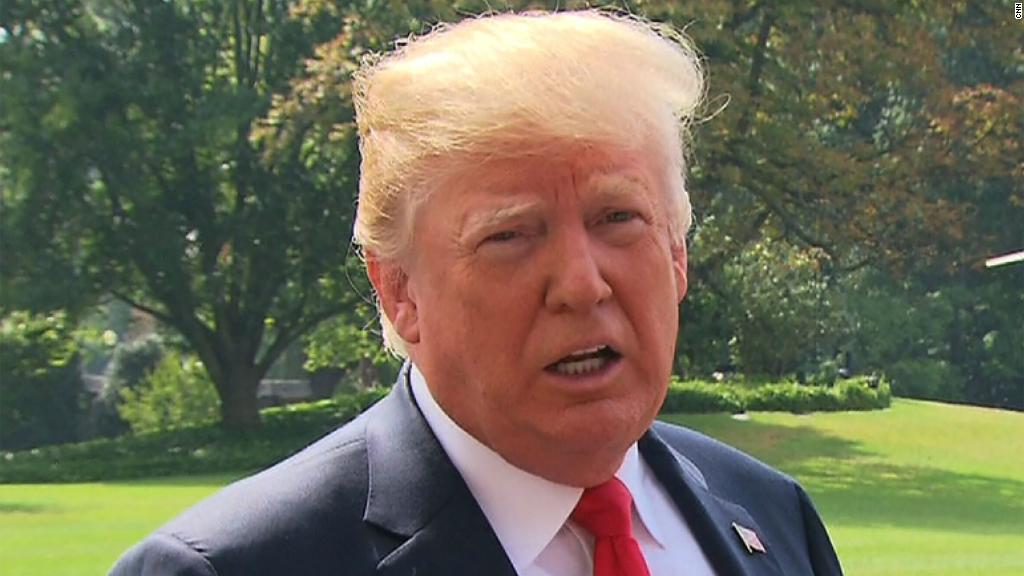

Last week, President Donald Trump suggested in a tweet that companies could report results every six months instead of quarterly.

"That would allow greater flexibility & save money. I have asked the SEC to study!" he tweeted.

Quarterly reporting seems like a good thing — transparency ensures informed decision-making by investors. And critics of Trump's idea have cited concerns over a lack of transparency leading to increased investor risk.

Yet in practice, quarterly reporting has evolved into a system of managing primarily for the quarterly numbers, with a net result of distorting financial performance negatively, much in the way teaching students solely to perform well on a standardized test distorts their learning.

The focus on quarterly results has brought us unprecedented share buybacks which artificially boost stock prices, non-strategic cost-cutting, less investment in longer-term basic and applied research (versus product development), as well as an unhealthy pressure on labor costs.

For instance, from 2003 to 2012, the 449 companies publicly listed in the S&P 500 index used 54% of their earnings to buy back their stock, and another 37% went toward paying dividends, leaving little left to invest in employees or innovation.

Additionally, a study published in The Journal of Accounting and Economics found that 78% of CFOs would sacrifice long-term value to make their quarterly earnings targets. The study found they would cut spending, delay starting a beneficial project, or book revenues ahead of time just to meet short-term earnings expectations.

And a study published in The Journal of Accounting Research found that frequent disclosure causes economic inefficiency, even as it may create price efficiency, or short-termism.

Analysis: Why we need quarterly earnings reports

Yet companies focused on the long-term outperform the short-term players. The McKinsey Global Institute and FCLT Global tracked company performance from 2001 to 2014 and found that for long-term oriented companies, average market capitalization was 58% higher, average company profit was 81% higher, average company earnings were 36% higher, and average company revenue was 47% higher. They also created 132% more jobs.

Some investors and corporate leaders have been calling for more focus on the long-term. BlackRock CEO Larry Fink, for instance, wrote to CEOs in 2017: "We look to see that a company is attuned to the key factors that contribute to long-term growth: sustainability of the business model and its operations, attention to external and environmental factors that could impact the company, and recognition of the company's role as a member of the communities in which it operates." He criticizes short-termism for driving excessive company share buybacks.

And the CEO Force for Good Strategic Investor Initiative, co-chaired by Vanguard Chairman Bill McNabb, is working with dozens of CEOs to incorporate long-term planning into reporting to investors. Warren Buffett and Jamie Dimon wrote an article in The Wall Street Journal encouraging public companies to stop issuing quarterly reporting guidance, arguing that it can stifle long-term investments.

The current pace of rapid technological, societal, and environmental change requires companies to invest in innovation and hire good people if they are to remain competitive. Being competitive means a focus on short-term results, of course, but with a longer-term plan in place that at times may require reduced profits in one or more quarters, in order to see higher profits later. The pharmaceutical industry, for example, needs 30 years on average to bring a drug to market.

It's unclear if moving to semi-annual reporting will cure corporate short-termism, but it's a step in the right direction.

Unilever is a case in point: Its CEO announced that he would cease quarterly reporting in 2009 to focus on the longer-term trends and opportunities for the business. The stock price has tripled since then.