If you're not clamoring to throw yourself back into the stock market, try a fund that really spreads your money around, and keeps it moving so you don't suffer from volatility sickness.

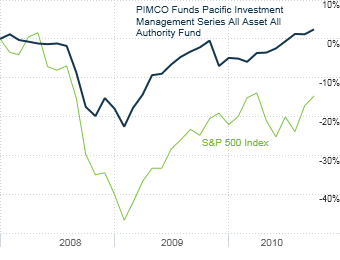

Many pundits enjoy the fluidity of PIMCO's All Asset All Authority Fund, which invests in other Pimco mutual funds that are exposed to global bonds, stocks, real estate and commodities. The All Asset fund uses the S&P 500, and the rate of U.S. inflation plus 6.5% as its benchmarks.

"Investors learned a good lesson in 2008: The market can't go up forever," says Jay Freeberg, a partner at JRF Asset Advisors. "This fund gives our clients the upside if the market moves higher, and protects them on the downside."

While the fund has gained 10% this year, its performance during the brutal year of 2008 is what's most impressive. That year, the S&P 500 lost 38% of its value, while the Pimco fund only shed 7%.

That performance is why it's among the top holdings at R.W. Roge & Co., a financial planning and investment management firm.

"If you're going to own a single fund, that's the one to own," said founder and Chief Executive Ron Roge.

More galleries