Still anxious about the pace of the economic recovery, consumers are barely spending. And when they have the rare and sudden urge to open up their wallets, they're not heading to Sears or Kmart stores.

Chances are they're shopping at rivals like Wal-Mart and Target, according to analysts.

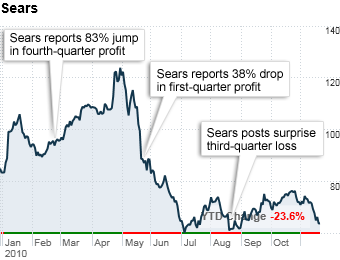

Shares of Sears Holding Corp, which operates Sears, Kmart and Lands' End, have been battered over the course of the year as the company continues to post disappointing earnings.

Last week, the retailer reported its second straight quarterly loss, which widened to $218 million from a year earlier. The company also reported a 5% drop in third-quarter revenue, dragged down by weakness in home appliance and clothing sales.

UBS analyst Neil Currie said those those results could provide a catalyst for further downside risk to Sears' stock.

Influential investor Bill Miller sold all his shares of Sears during the third quarter, according to a Legg Mason Capital Management Inc. SEC filing.

More galleries