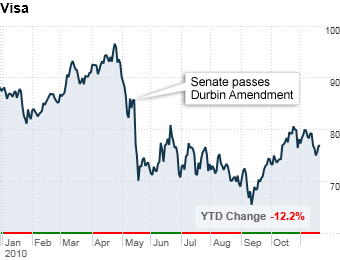

The uncertainty surrounding the impact of the so-called Durbin Amendment has knocked down Visa's stock. The provision would limit the fees financial services companies collect from debit card swipes. The impact of the amendment is still unknown, and investors are anxious to find out what the Federal Reserve will actually implement.

FBR Capital Markets analysts expect the Fed will release a draft of the new rules before the year is over, and they anticipate that Visa will be able to handle any potential losses.

"Our scenario analysis indicates the potential impact from the Durbin Amendment is manageable," said FBR analyst Scott Valentin in a recent note to clients, reiterating his "outperform" rating on the stock. He also has a price target of $96, up almost 25% from its current share price.

Donald Hodges, fund manager and founder of Hodges Capital Management Inc. in Dallas, bought shares of Visa five months ago and thinks the stock has bottomed out. Shares of Visa account for more than 4% of Hodges' fund of 25 blue chip companies and the company is among the fund's top ten holdings.

"We don't see Visa as having much more downside risk," Hodges said. "It's somewhat dependent on the economy now, but we're optimistic that retail customers are coming back and that the number of transactions on Visa cards will rise."

NEXT: Reseach in Motion: Cut it loose