Secrets of extreme savers

You can put away a lot more than the average American without living a deprived life.

Savings Rate: 60%

Home: Alexandria, Va.

Occupations: Marcus is a lieutenant colonel in the Army; Sheila is a project manager for a training company

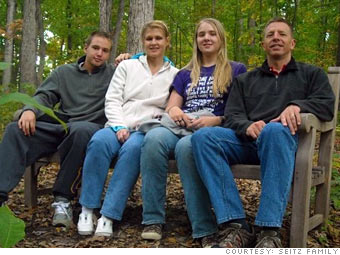

Marcus and Sheila Seitz earn more than $250,000 a year, but you might not guess that from the modest home they share with their teenage children, a 1,700-square-foot townhouse, or the family vacations of camping trips and visits to D.C.'s free museums. "We've always lived below our means," says Marcus, who hopes to retire by age 50. "By saving now, we will have unlimited options later on." Those options might include traveling for a year or moving to Vegas, where Marcus hopes to test out his poker skills and Sheila would like to teach.

With those goals in mind, the Seitzes do all they can to maximize their savings. By living in a townhouse rather than a McMansion, they not only have a smaller mortgage payment (their only debt), but they also pay less in property taxes, utilities and maintenance. The Seitzes also take advantage of the perks of being in the military (Sheila was also in the military before moving to the private sector), shopping at military stores and taking advantage of the post-9/11 GI bill, which allows them to transfer Marcus' educational benefits to their children so their college expenses will be covered.

NEXT: Cut down on everyday expenses

Last updated July 19 2010: 9:04 AM ET