10 ways to make real money

These hidden values offer the chance for returns that shine -- as long as you've got an appetite for some risk.

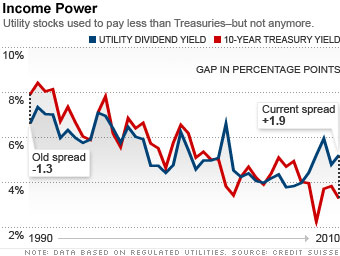

How to invest: Focus on firms that generate cash to fund their dividends. Claud Davis, analyst at MFS Investment Management, recommends PPL, a Pennsylvania-based utility yielding 5%. Money stock columnist Pat Dorsey likes Exelon, a Chicago-based operator of electric utilities and nuclear plants. After paying out about $2 a share in dividends each year, Exelon still has $1.50 a share left over. Yet it trades at about 35% less than what Morningstar analysts think it's worth. Among funds, Utilities Select Sector SPDR ETF is a good low-cost option, with an expense ratio of 0.21%. Among actively managed funds, Franklin Utilities is one of the least volatile and still yields 4%. It does charge a sales commission of 4.25%.

What could go wrong: Profits could be threatened by stricter environmental rules requiring more infrastructure spending, while regulators could push back against rate increases.

More galleries

Last updated August 13 2010: 3:51 AM ET