10 ways to make real money

These hidden values offer the chance for returns that shine -- as long as you've got an appetite for some risk.

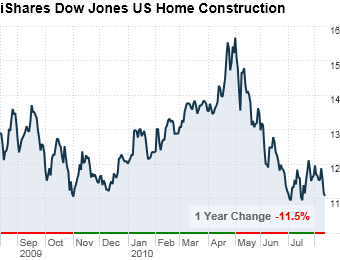

How to invest: Lennar was among the first to return to profitability after the housing crash; analysts at J.P. Morgan look for earnings per share to roughly double between this year and next. KB Home is expected to become profitable next year for the first time since 2007. A less risky option than a single stock: iShares Dow Jones US Home Construction, an ETF with about 64% of its assets in homebuilders.

What could go wrong: Homebuilder prices jump around a lot as monthly data are released about starts, sales and homebuilder confidence. And with unemployment remaining high, it might take longer than the optimists hope for construction and profits to pick up again.

NEXT: European exporters

Last updated August 13 2010: 3:51 AM ET