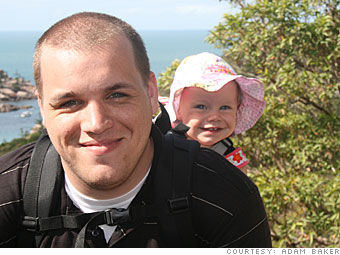

Baker, 26, sold his belongings so that he, his wife and his daughter could be debt-free and travel the world.

Strategy: Sell belongings

Advice: Figure out what you really need. Get rid of everything else.

When my wife and I got engaged, she was finishing up her last year of college and was about to start her first year as a teacher. Just a year earlier, I had started a property management company which was seeing the first few quarters of success.

Between the two of us, we had $55,000 in student debt and $17,000 in consumer debt spread amongst three credit cards, loans on 2 cars and even a loan for the engagement ring. We had everything but a mortgage - and, yes, we were house shopping.

A month after our first anniversary, our daughter Milligan was born, and that's when we sat down and really evaluated our life and began to wake up a little. We decided that we would sell everything we own, pay off our consumer debt, and spend the next year traveling abroad.

We started out by selling everything we couldn't fit in two backpacks. Our furniture went on Craigslist, our book and media collections went on Amazon and we put everything else on eBay. That meant everything from extra blenders and video games to baby cribs and wedding presents we never used. We also sold both our cars.

Along with selling our stuff to make some money, we slashed our expenses by cutting up our credit cards and spending only cash -- and just on necessities. Eleven months later, we had paid off all our consumer debt, including our three credit cards.

Not only that, we were able to save another $17,000 for our traveling dreams, and took off overseas for 11 months. Next up? Our student loans. They don't stand a chance.

NEXT: Dustin Taylor

Last updated October 21 2010: 12:29 PM ET