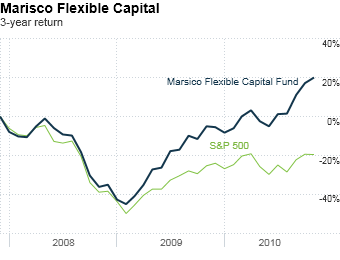

Manager Doug Rao doesn't like to be boxed in. Too many mutual funds, he says, operate with tight strategy constraints designed to serve the asset allocation needs of institutional investors. Rao's charter, by contrast, explicitly allows him to range across the globe and buy equity or debt in companies of all sizes. He's used that adaptable approach to deliver 9.5% annualized returns since the fund's launch in 2006. Rao's stellar 51% return in 2009 was boosted by foreign winners such as Chinese search engine Baidu. He also bought the high-yielding preferred stocks of banks that, during the crisis, were selling at fire-sale prices. Right now Rao is encouraged by U.S. recovery stories, including U.S. Bancorp. The bank -- the best managed in the U.S., Rao says -- made money every quarter and gained market share during the financial crisis. Yet, he says, it still trades 35% below where it was before the market meltdown. He's also been buying shares of giant auto-parts supplier Borg Warner. Rao sees opportunity in the U.S. auto industry, which is currently producing cars more slowly than Americans are scrapping old ones.

NEXT: Cambiar Small Cap