It wasn't supposed to be like this in Minneapolis. Like most other Midwestern metropolises, the Twin Cities showed moderate gains during the housing boom. They could have held up, but they haven't.

Since peak in April 2006, values have fallen 34%, with 8% of that loss coming over the past six months. Homes are now only worth 14% more than in 2000.

Sellers in Minneapolis have had to rethink their expectations over the past half year. They have been waiting an average of 45 days before they cut their prices to better match the market, according to data from Trulia, and cut the price an average of 9%.

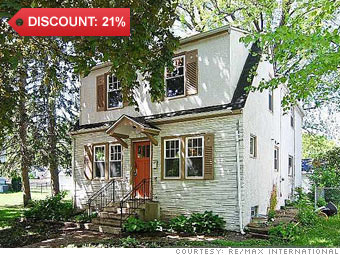

This roomy house located four miles northwest of downtown has gone through seven price reductions since last June, dropping 20% to $114,900.

Edie Sher, the agent for this listing said, "To be competitive, you want to price it below market value. You have to be aggressive."

Much of the area's latest home price decline has happened far from the core, according to Tom Streitz, director of Housing Policy and Development for the city. "Our numbers are down and foreclosures are up in the suburbs," he said.

NEXT: Detroit