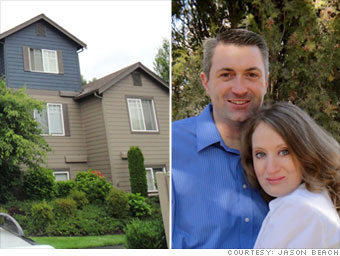

Names: Jason and Heather Beach

Hometown: Provo, Utah

Like many homeowners, Jason and Heather Beach have had a tough time selling their home. With few options left, the two rented their Kent, Wash., condo out at a loss after moving to Provo, Utah, where Jason could attend school.

They had bought the condo near the height of the housing boom, paying $207,000 for the place. Now it's worth half that, at between $90,000 and $115,000.

Jason was hoping that Bank of America would reduce their mortgage by $100,000 or so, like it said it would do for some 200,000 homeowners as part of the settlement deal. But he soon realized his loan wouldn't make the cut.

"Since it's no longer our primary residence, our chances of qualifying for one of the government programs is virtually nil," said Jason. "I am current with my payments -- my wife and I have worked very hard to be responsible with our money and it feels now that we're kind of getting screwed for it," said Jason.

In addition, when they contacted Bank of America, the Beaches discovered that the bank had packaged their loan with a bunch of other mortgages and sold it to investors. The investment group has not decided yet to authorize BofA to modify its mortgages, he said.

So, instead of realizing big savings, the Beaches have been put on a list.

"BofA [said they] will notify me if sometime in the future the investors do become part of the settlement," he said. "So for the time being, it looks like there are still a group of homeowners like me who are completely on our own."

A bank spokesman, Rick Simon, said they may be eligible for the refinance/interest reduction program, but guidelines and processes for that program have not been finalized or announced.

NEXT: 'We need some meaningful relief'