Uncertainty continues to loom large over the stock market.

Investors have a list of unanswered questions weighing on them. Chief among them: When will the Federal Reserve finally begin cutting back on its monthly $85 billion bond-buying program? Will the U.S. government shut down on Oct. 1 or default on its debt?

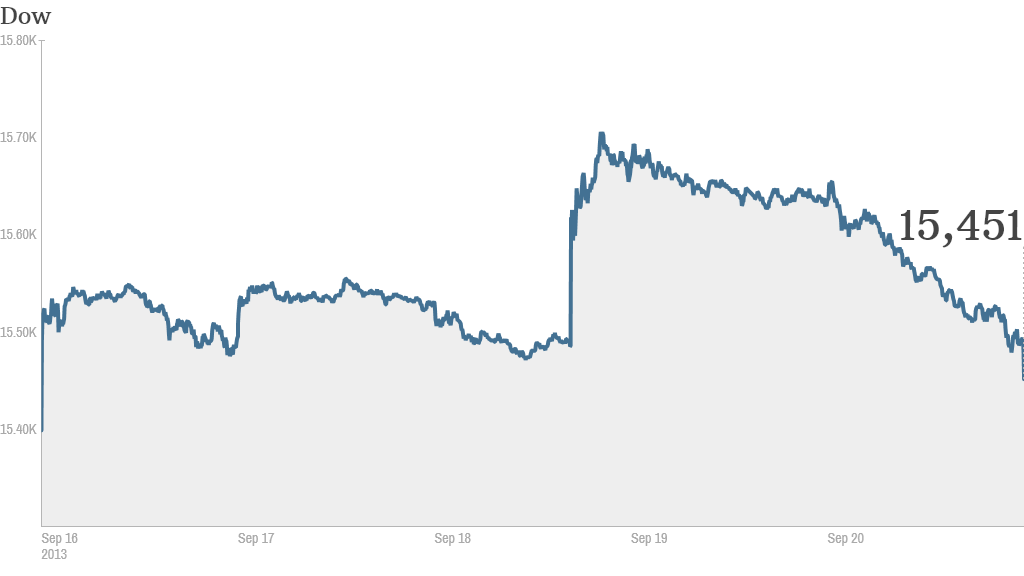

These unknowns spooked investors towards the end of last week, causing the Dow Jones Industrial Average to drop 180 points on Friday. The S&P 500 and Nasdaq also closed down 0.4% and 0.7% respectively. However, despite Friday's sell-off, stocks ended the week up between 0.5% and 1.3%.

Answers on the economy: Investors will get a feel for the strength of the U.S. economic recovery via several key reports due out throughout the week.

The third estimate of second-quarter gross domestic product, the broadest measure of economic activity, is due out on Thursday. Economists surveyed by Briefing.com are expecting that GDP rose at a 2.5% annual rate from April through June, unchanged from the second estimate released last month.

There will also be a smattering of reports on the housing market, including Case-Shiller's 20-city index, FHFA housing price index and new home sales.

Related: Are we still heading toward 5% mortgages?

How consumers are feeling about the economy will also be in play, with reports on consumer confidence, personal income and spending and Michigan sentiment on tap.

Blackberry's woes get real: Ailing smartphone maker Blackberry will once again be in the spotlight this week when it releases second-quarter earnings on Friday. The company warned last week that it will report a loss of nearly $1 billion for the second quarter and slash 40% of its global workforce.