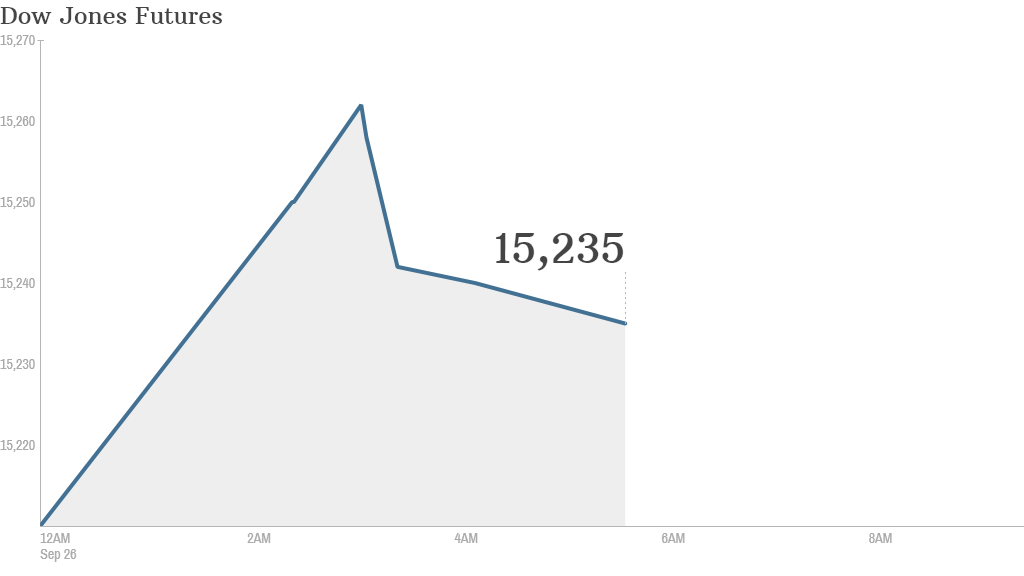

After five straight days of losses, U.S. stocks could start with gains Thursday.

U.S. stock futures were higher, lead by the Nasdaq, with gains of 0.6%.

After hitting record highs earlier in the month, market sentiment has taken a hit as investors worry about political gridlock, a possible government shutdown and federal debt issues. These issues all have the potential to hurt America's economic growth.

"The US [is] running the show as usual, with uncertainty surrounding budget negotiations (deadline 1 Oct) and the debt ceiling (deadline 17 Oct) of the world's No.1 economy keeping optimism in check," said Mike van Dulken, head of research at Accendo Markets, in a note to clients.

Investors are now waiting for the U.S. government to provide its final estimate of second-quarter GDP at 8:30 a.m. ET, which increased at a 2.5% annual rate from April to June, according to preliminary reports.

The government will also release its weekly report on initial jobless claims, which are expected to total 325,000 for the week ended Sept. 21, according to the consensus forecast from Briefing.com.

Related: Fear & Greed Index, wallowing in fear

In corporate news, JCPenney's (JCP) stock plunged in premarket trading, after plummeting 15% on Wednesday, after reports that the retailer might seek $1 billion through a stock sale.

Nike (NKE) and Accenture (ACN) are set to release quarterly results after the closing bell.

Shares of Bed Bath & Beyond (BBBY) jumped in premarket trading after the retailer posted quarterly earnings Wednesday that beat expectations.

But overall, U.S. stocks fell Wednesday. The Dow has lost more than 400 points, or nearly 2.6%, during its five consecutive days of losses.

European markets were edging lower in midday trading.

Asian markets ended with mixed numbers. Markets in China declined, but Japanese stocks rallied -- with the Nikkei jumping by 1.2% -- on talk of a potential corporate tax cut.