It's day 2 of the government shutdown. And now investors have become more nervous about the ramifications of the political stalemate in Washington.

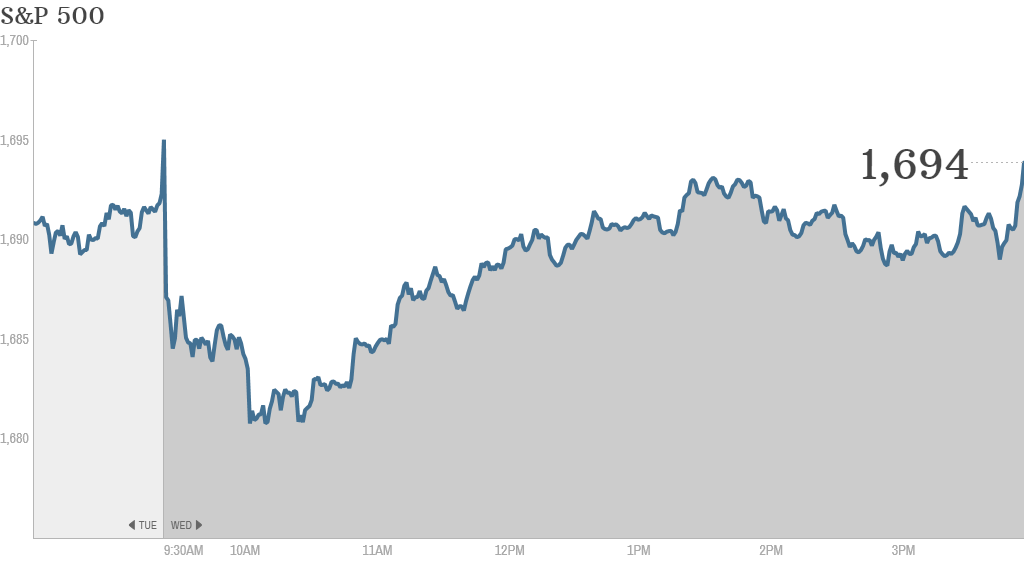

The Dow, the S&P 500, and the Nasdaq closed Wednesday with modest losses, pulling back from steeper drops in morning trading. Stocks rallied on Tuesday, the first day of the shutdown.

The biggest worry now: the potential for a government default on October 17. If Congress fails to raise the debt ceiling, the U.S. government will be unable to pay all of its bills later this month.

Treasury Secretary Jack Lew said Tuesday that the government has started to use the last of its "extraordinary measures" to ensure it stays below debt ceiling.

Click here for more on stocks, bonds, commodities and currencies

With Congress unable to agree on a deal to fund the government past Monday, more than 800,000 federal workers are being furloughed without pay this week. In addition, government agencies are curtailing their services, and federal museums, parks and monuments are closed to the public.

Quantitative strategists at Bank of America Merrill Lynch noted in a report that previous shutdowns have been mostly positive for the stock market. But the big difference this time around is the rapidly approaching debt ceiling.

Investors reacted to economic news as well. Payroll processor ADP's monthly report on private-sector jobs showed that the U.S. added 166,000 jobs in September, slightly below expectations. The report has more significance this month than usual. It appears increasingly unlikely that the U.S. government's monthly employment report will be released this Friday because of the government shutdown.

Related: Federal workers sound off on the shutdown

What's moving: Shares of agriculture technology firm Monsanto (MON) dropped after the company missed earnings expectations.

Shares of Tesla (TSLA) fell following an analyst downgrade. The stock still remains one of the best performers of the year as individual investors have embraced the maker of the electric Model S.

Many investors and analysts are skeptical of its current value. Even after Wednesday's dip, at $190 per share, Tesla is overvalued compared to where Wall Street analysts think it should be trading.

StockTwits user RamC warned, " Read before buying," pointing to CNNMoney's article on how individual investors were cutting their exposure to the stock . "$TSLA A trap for small investors? http://stks.co/ektl."

Makisupa488 wrote: "$TSLA Has it topped? Finally? Hope so :) Bearish."

Despite a drop in the overall stock market, several Internet companies hit new 52-week highs, including Priceline (PCLN), Amazon (AMZN), Netflix (NFLX) and Yahoo (YHOO).

Traders on StockTwits expect Priceline to keep surging. GrapeApe wrote, "$PCLN seems like the perfect stock, the only question is how much do you want to make."

"$PCLN rich become richer here," wrote Tstrar.

Related: Fear & Greed Index still languishing in fear

IPO frenzy: The IPO boom continued this week despite the government shutdown. Three companies debuted and two of them quickly shot higher.

Real estate broker Re/Max (RMAX ) closed 22% higher, and Burlington Holdings (BURL), the owner of the Burlington Coat Factory, ended up 47%.

But the parent company of the iconic Empire State Building disappointed. Shares of the building's owner, the Empire State Reality Trust (ESRT), rose less than 1%. And that's after the company priced its offering at the low end of its range Tuesday night.

World markets: European markets ended lower, and Asian markets ended mixed.