World markets began rising Wednesday afternoon as investors grew increasingly confident that U.S. lawmakers would be able to broker a deal to end a government shutdown and allow it to continue paying its bills.

According to sources in Washington, the Senate reached a deal on the debt ceiling in the morning, but the agreement still needs approval from the House of Representatives, which is still far from certain.

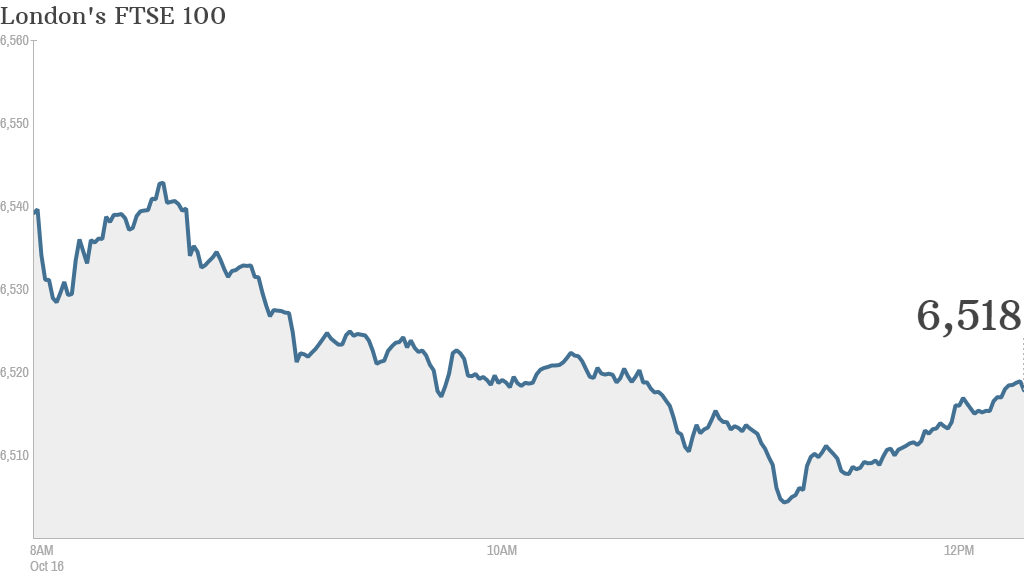

All European markets started Wednesday in the red. But some major indexes changed course in afternoon trading. London's FTSE 100 index fell in the morning but was back in the black late in the day, as traders hoped that the U.S. government will reach an agreement.

Market sentiment was improving as the hours passed -- U.S. stocks started the day with a 1% jump -- with American investors hoping the U.S. could avoid hitting the debt ceiling.

Related: What happens if the U.S. hits the debt ceiling

In Asia, Tokyo's Nikkei and Australia's ASX All Ordinaries index ended the trading day in positive territory. Hong Kong's Hang Seng dropped 0.5% and the Shanghai Composite shed 1.8%.

Ratings agency Fitch announced Tuesday that it had put the U.S. on notice for a possible downgrade, citing the "political brinkmanship" on display in Washington as a default risk.

Fitch currently has U.S. debt at its highest grade -- AAA, but currently it's on "rating watch negative," meaning there is increased possibility of a downgrade in the near future.

Related story: 6 ways a default could hurt the world

Senate leaders had said earlier Tuesday they made "tremendous progress" toward an agreement to end the partial government shutdown and raise the debt limit.

--CNNMoney's Alanna Petroff contributed to this report.